[ad_1]

Allan Akins/iStock through Getty Pictures

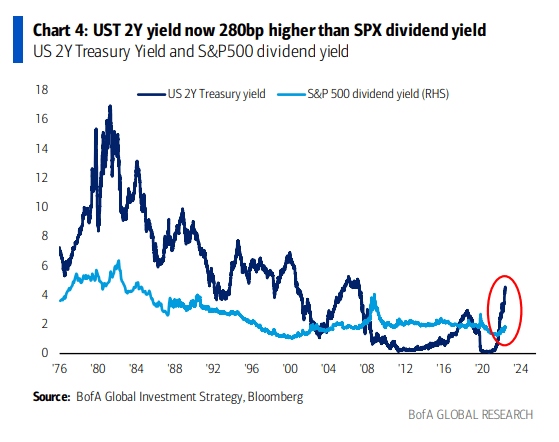

The short-term fairness threat premium is again to ranges not seen since earlier than the Monetary Disaster and money is piling into bonds, BofA Securities says.

The U.S. 2-year Treasury yield is now 280 foundation factors larger than the S&P 500 dividend yield (SDY), the widest unfold since 2007 and buyers are “flooding to short-duration bonds (NASDAQ:SHY),” strategist Michael Hartnett wrote within the weekly Circulation Present observe.

The chance to equities is that this continues through rotation from shares (NYSEARCA:SPY) (QQQ) (DIA) (IWM) (IWB),” Hartnett mentioned.

As well as, “US business financial institution deposits (are) down file $360bn since April ’22 peak ($18.1tn),” with rotation to T-bills and different debt a giant issue,” Hartnett added.

However it’s essential to notice that the “final nice disorderly drop in financial institution deposits was 1994 (Orange County, Mexico peso credit score occasions),” he mentioned.

A bullish inventory setting could possibly be discovered, although, if there’s a excessive within the U.S. greenback (DXY) (USDOLLAR) (UUP) that signifies a shift from quantitative tightening to quantitative tinkering. That is the place central banks develop into “fearful of market penalties of liquidity withdrawal” like these seen within the U.Ok., Hartnett mentioned.

The three trades

Hartnett outlined three commerce situations:

“We’re bearish regardless of ubiquitous bear sentiment; inflation shock, charges shock ongoing + recession shock & credit score shock beginning; new highs in yields, spreads, low in shares coming.”

Might the 10-year yield topping 4.5% carry concerning the sought-after washout in sentiment?

Hey there, gaming enthusiasts! If you're on the hunt for the following popular trend in…

Understanding the Principles Before we get into the nitty-gritty, let's start with the basics. Precisely…

At its core, a vacuum pump is often a device that removes natural gas molecules…

For anyone in Newcastle-under-Lyme, getting around efficiently and comfortably often means relying on a taxi…

Before we get into the nitty-gritty of their benefits, let's first clarify what Modus Carts…

Delta 10 is often a cannabinoid found in trace volumes in the cannabis plant. It…