[ad_1]

(Bloomberg) — Euphoria is sweeping each nook of Wall Road within the wake of the newest information that implies inflation is peaking from a four-decade excessive. But massive cash managers are in no temper to have a good time – betting that the world must deal with elevated costs for years to come back, in a game-changer for investing methods of all stripes.

Most Learn from Bloomberg

JPMorgan Asset Administration is clinging onto a report allocation in money in a minimum of one in all its methods whereas a hedge fund options crew at UBS Group AG is staying defensive. Man Group quants anticipate the nice inflation commerce to endure, with all indicators suggesting worth pressures will keep robust for an extended whereas but.

Their cautionary stance comes amid lower-than-expected worth information for October that’s spurred an enormous cross-asset rally with the likes of Citigroup Inc. betting that the US central financial institution will reasonable its hawkish threats.

“The trail to a mushy touchdown the place the Federal Reserve is ready to deliver inflation all the way in which again down to focus on with out inflicting materials financial harm continues to be slim,” mentioned Kelsey Berro, a fixed-income portfolio supervisor at JPMorgan Asset Administration. “Whereas the route of journey for inflation needs to be decrease, the tempo of deceleration and the final word leveling off level stay extremely unsure.”

JPMorgan Asset stays invested in extremely rated short-term debt because it sees enduring worth pressures. The agency’s chief funding officer has lengthy warned towards sticky inflation that different had predicted would subside after the pandemic.

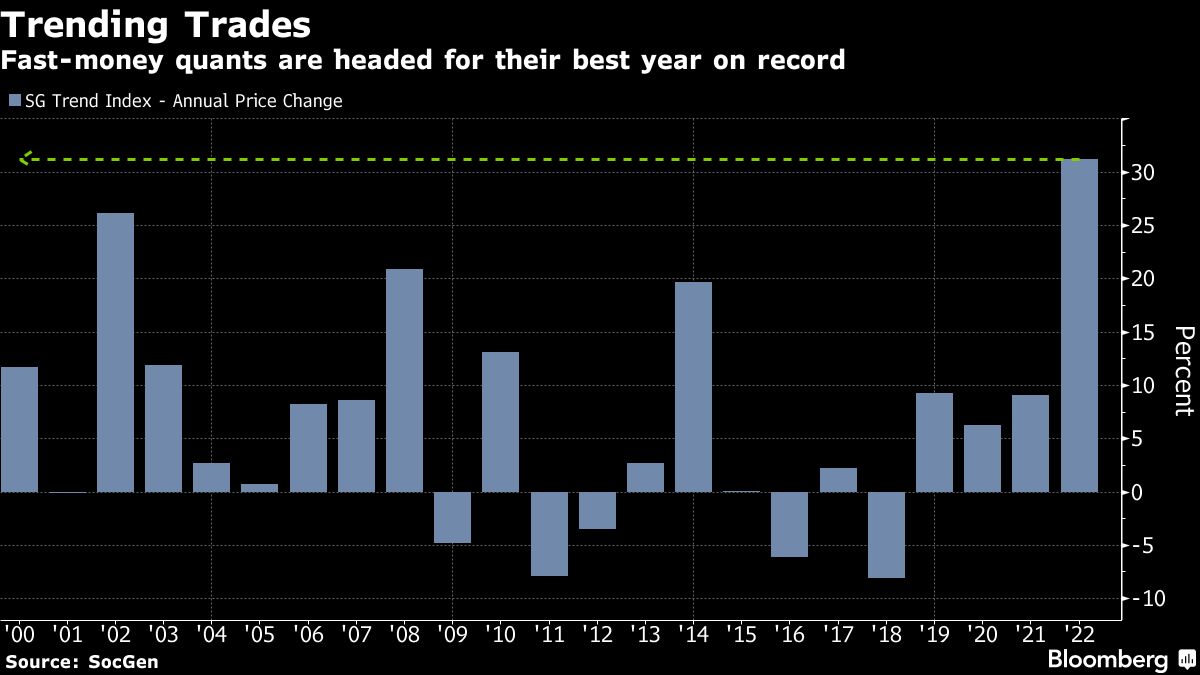

At Man AHL, the agency’s quantitative funding program, cash managers anticipate trend-following methods, which have been an enormous winner after using relentless inflation-driven worth tendencies, to proceed to outperform. A wide range of carry trades that reap the benefits of worth variations stay engaging as inflation persists, in accordance with the world’s largest publicly traded hedge fund agency.

“It actually was the case that folks had been too optimistic concerning the outlook for markets earlier this yr, and it’s nonetheless very attainable that they’re too optimistic proper now,” mentioned Russell Korgaonkar, chief funding officer of Man AHL.

A measure of the market’s inflation expectations is extra in keeping with the assumption that the worth development forward will development nearer to the Fed goal of two%. Merchants see borrowing prices peaking subsequent yr whereas pricing in a half-point Fed hike in December.

However any cash supervisor with hopes of quickly easing worth pressures could also be getting forward of themselves, in accordance with Financial institution of America Corp.

“‘Inflation stick’ of briskly rising companies and wage inflation is right here to remain,” Financial institution of America strategists led by Michael Hartnett wrote. “Inflation will come down however stay above” ranges of the previous 20 years.

Buyers have additionally been venturing exterior the protection of money — which they’d turned to as an alternative choice to equities — in what may quantity to a wager that inflation is coming down. In current weeks, cash-like exchange-traded funds have seen report outflows, with almost $5 billion exiting the $20 billion iShares Brief Treasury Bond ETF (ticker SHV) within the fund’s largest two-week outflow on report, in accordance with information compiled by Bloomberg.

However cash managers similar to UBS’s hedge fund options enterprise should not prepared to maneuver away from their defensive positioning simply but.

“We now have been getting ready our portfolios for this new regime of upper inflation and decrease development and we anticipate danger belongings to stay unstable,” mentioned Edoardo Rulli, deputy chief funding officer of UBS’s hedge fund options enterprise. “We stay defensively positioned with beta to fairness and credit score markets at traditionally low ranges.”

Ed Clissold, the chief US strategist at Ned Davis Analysis Inc., additionally says it could be too quickly to leap again into shares or bonds. The agency continues to be underweight equities and chubby money.

“Money yields may stay engaging,” Clissold mentioned. “Aggressive Fed easing would not going come till one thing breaks. That may imply decrease danger asset costs, like shares.”

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.

In the rapidly evolving digital marketing landscape, finding content creators who authentically represent your brand…

Before diving into the specifics, it's important to understand what a demolition contractor does. These…

Hey there! If you're cruising around Arlington and suddenly find your windshield cracked or shattered,…

Hello there! If you're searching for the top asphalt paving companies in Indiana, you're in…

Hey there! If you've ever driven on a smooth, sleek road and thought, "Wow, this…

Hello, enterprising souls of Anaheim! Are you eager to breathe new life into your commercial…