[ad_1]

(Bloomberg) — Taiwan Semiconductor Manufacturing Co. reported higher-than-expected quarterly income, signaling the chip big is benefiting from market share positive aspects to climate an business slowdown.

Most Learn from Bloomberg

Income on the world’s largest contract chipmaker rose 48% to about NT$613 billion ($19.4 billion) within the third quarter, in keeping with Bloomberg’s calculations. Analysts estimated NT$603 billion on common.

Rising income at Apple Inc.’s most necessary chipmaker alerts that the biggest gamers within the $550 billion semiconductor business could keep away from the extreme downturn traders have feared, helped by resilient demand for some electronics merchandise within the face of rising rates of interest and hovering inflation. Morgan Stanley this week projected a return to progress for the chip business by the second half of 2023.

Different chipmakers warned in latest weeks that they’re dealing with a harder market as inventories construct up and orders are being lower by knowledge heart in addition to shopper tech purchasers. Micron Know-how Inc. and Kioxia Holdings Corp. are slicing output to try to rebalance provide and avert a worth crash.

Earlier on Friday, Samsung Electronics Co. reported its first revenue drop since 2019. Shortly earlier than Samsung’s outcomes, US processor and graphics chip maker Superior Micro Gadgets Inc. additionally missed estimates with its third-quarter gross sales figures, which got here in $1 billion shy of its personal forecast.

Shares of TSMC fell 2.9% in Taipei on Friday and have misplaced 29% this yr.

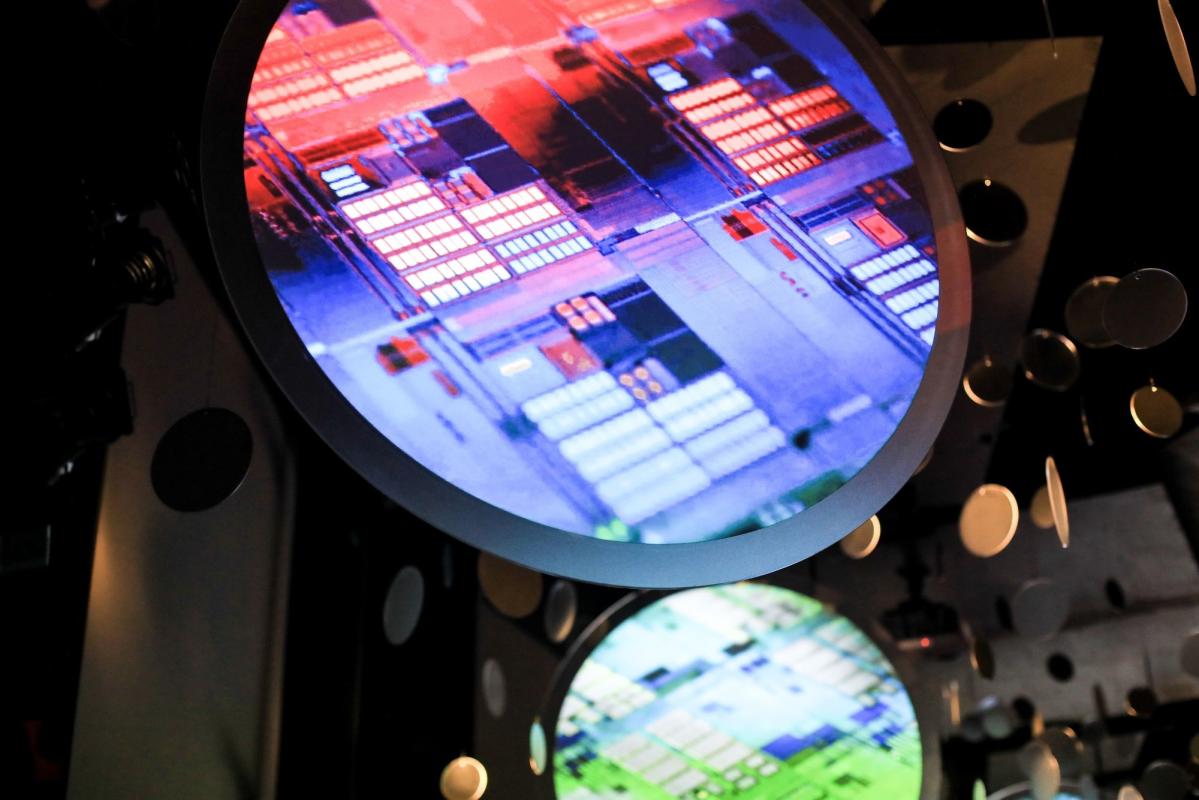

TSMC, the world’s most superior maker of silicon chips, has benefited from Apple launching new sorts of chips to spice up the efficiency of its gadgets. Nonetheless, Bloomberg reported in September the Californian firm is backing off plans to extend manufacturing of its new iPhones, elevating questions on underlying electronics demand.

What Bloomberg Intelligence Says:

“For now, abroad capability enlargement might be entrance and heart, particularly within the US and Japan, as TSMC pushes to satisfy prospects’ diversification requests and rises to the problem of rising competitors from Samsung and Intel. Quickly rising depreciation and materials prices, coupled with rising uncertainty in smartphone demand, are placing a cap on its gross margin.”

–Charles Shum, Bloomberg Intelligence

Click on right here for the analysis

To diversify past chips for electronics, TSMC can be in search of progress in areas comparable to next-generation automobiles. The Taiwanese firm is betting on rising demand for semiconductors as automobiles develop into electrified and extra digitized.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.

In the rapidly evolving digital marketing landscape, finding content creators who authentically represent your brand…

Before diving into the specifics, it's important to understand what a demolition contractor does. These…

Hey there! If you're cruising around Arlington and suddenly find your windshield cracked or shattered,…

Hello there! If you're searching for the top asphalt paving companies in Indiana, you're in…

Hey there! If you've ever driven on a smooth, sleek road and thought, "Wow, this…

Hello, enterprising souls of Anaheim! Are you eager to breathe new life into your commercial…