[ad_1]

Marcio Silva/iStock Editorial through Getty Photographs

The “Dr. Copper and Fearful Gold” indicator is pointing to rising investor confidence and “stellar” stock-market returns forward, Leuthold Group Chief Funding Strategist James Paulsen says.

Paulsen wrote in a latest word that the indicator, which measures the ratio of copper costs (HG1:COM) to gold costs (XAUUSD:CUR), serves as proxy for investor sentiment because of what every steel’s worth signifies in regards to the financial system.

He mentioned copper costs (HG1:COM) traditionally characterize a number one financial indicator, as many industries use the steel in manufacturing. In contrast, gold costs (XAUUSD:CUR) sometimes go up when traders concern excessive inflation, recession or extreme market volatility, Paulsen mentioned.

Consequently, “the ratio of these two costs is an effective gauge of relative confidence sooner or later vs. concern – or, basically, stock-market conviction.” Paulsen wrote.

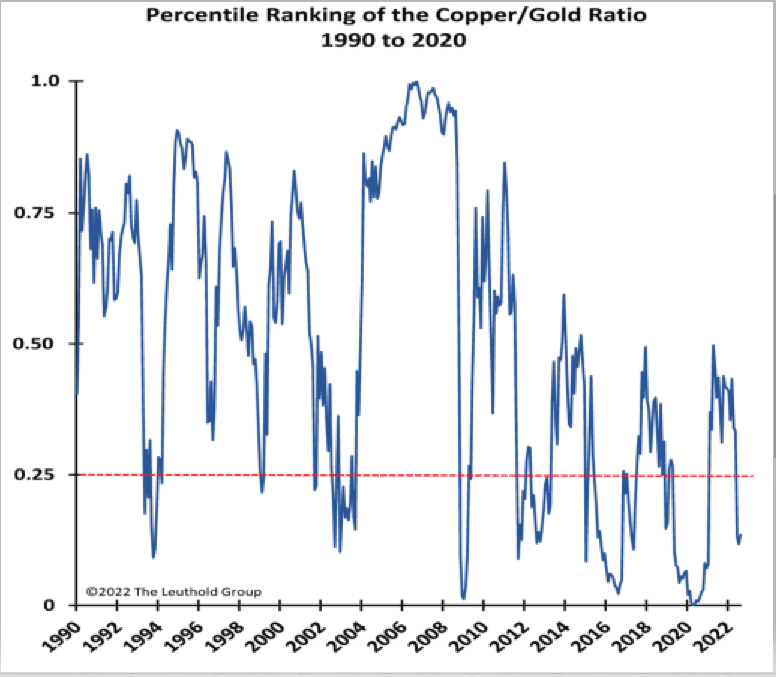

Proper now, the Dr. Copper and Fearful Gold indicator is sitting at simply its thirteenth percentile when measured in historic phrases stretching again to 1990:

Paulsen mentioned meaning “the comparative cheapness of confidence to concern” is decrease than it’s been 87% of the time over the previous 32 years.

“Exterior of the 2009 market backside, the pre-Trump election low in 2016 and the pandemic trough, confidence has by no means been any cheaper vs. concern than now,” he wrote. “When the copper/gold ratio has been in its decrease quartile (like at this time), ahead inventory market returns have been stellar.”

Paulsen mentioned that since 1990, the S&P 500 (SPY) has risen at a 21% annualized price over the following month any time the indicator has been at its twenty fifth percentile or decrease, as it’s at this time. In contrast, the blue chips solely gained a 5.3% common annualized price of return in months when the index sits above the twenty fifth percentile mark:

As for draw back threat, Paulsen wrote that the S&P 500 (SPY) traditionally declined simply 28.6% of the time over the approaching month at any time when the Dr. Copper and Fearful Gold indicator was in its backside quartile. In contrast, the blue chips have had a 38.8% probability of declines when the indicator sits above its twenty fifth percentile mark.

“Traditionally, when confidence has been this low-cost in comparison with concern, it proved to be a superb time to purchase the inventory market,” the economist mentioned. “Extreme concern and excessive undervaluation of confidence have traditionally tended to brighten the outlook for shares.”

Standard gold ETFs embrace the SPDR Gold Belief ETF (GLD), the iShares Gold Belief ETF (IAU) and the VanEck Vectors Gold Miners ETF (GDX).

Standard copper ETFs: The US Copper Index Fund (CPER) and the iPath Collection B Bloomberg Copper Subindex Whole Return ETN (JJC).

For extra macro market evaluation, click on right here.

In the rapidly evolving digital marketing landscape, finding content creators who authentically represent your brand…

Before diving into the specifics, it's important to understand what a demolition contractor does. These…

Hey there! If you're cruising around Arlington and suddenly find your windshield cracked or shattered,…

Hello there! If you're searching for the top asphalt paving companies in Indiana, you're in…

Hey there! If you've ever driven on a smooth, sleek road and thought, "Wow, this…

Hello, enterprising souls of Anaheim! Are you eager to breathe new life into your commercial…