The contrarian commerce is bullish on Treasuries whereas taking part in a danger bounce

[ad_1]

Olivier Le Moal

Treasury yields (NYSEARCA:TBT) (NASDAQ:TLT) (SHY) are breaking out to decade highs Wednesday, with the 10-year (US10Y) topping 4.10% for the primary time since 2008.

The tumble in bond costs has meant that even whereas inventory (NYSEARCA:SPY) (QQQ) (DIA) (IWM) (IWB) valuations have tumbled, fairness valuations relative to bonds have not adopted, MKM strategist Michael Darda highlighted in a observe.

The “fairness danger premium (the valuation hole between the earnings yield on shares and the yield on Treasuries) has really fallen for the reason that market topped in January,” Darda wrote.

“This additionally suits the complexion of the credit score markets extra broadly the place excessive yield (HYG) (JNK) and funding grade (LQD) (USIG) credit have offered off sharply this 12 months, however haven’t weakened massively relative to Treasuries (spreads stay close to historic averages),” he stated.

“A contrarian would seemingly be in search of a danger asset bounce right here whereas changing into more and more bullish on Treasuries,” Darda argued.

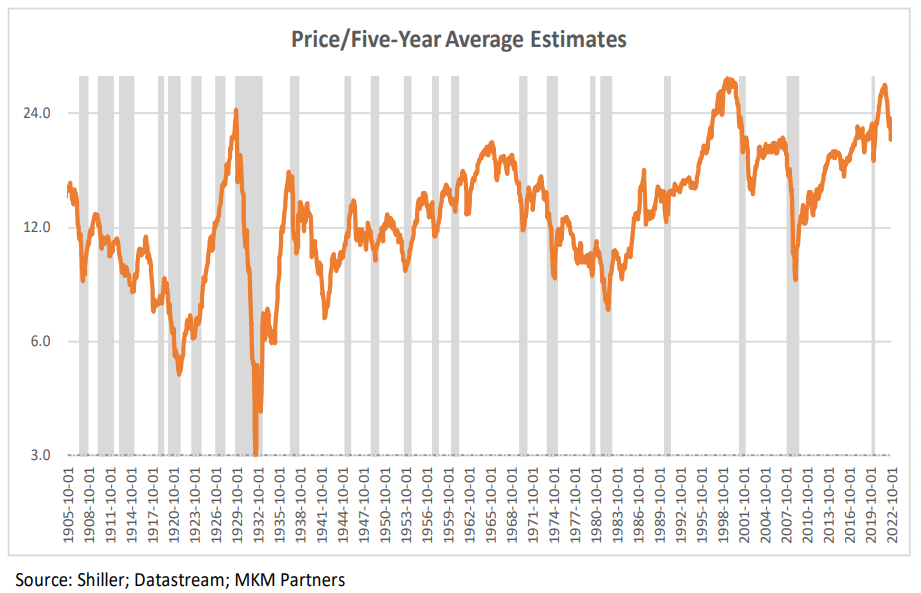

A ahead a number of utilizing 5-year common of estimates for the S&P (SP500) peaked at 28.5x in late 2021 and not too long ago tumbled to 20x, with the ahead a number of collapsing to 15x, Darda stated.

“There have solely been 3 times in historical past throughout which multiples contracted extra: 1930, 2001, and 2008,” he stated. “Though none of those represented “the low” for fairness markets, in every case the compression nonetheless gave technique to vicious bear market rallies.”

“The place we might be extra unambiguously bullish is on the Treasury market: the transfer in yields during the last 12 months in foundation factors has been historic, particularly in opposition to the backdrop of an inverted Treasury curve and the rising probability of a recession,” he added.

Citi says shares are pricing in a recession greater than some other asset class, however nonetheless have additional to go.

Source link