[ad_1]

Retail REIT Simon Property (NYSE:SPG) is scheduled to announce Q3 earnings outcomes on Tuesday, Nov. 1, earlier than market open.

The subsector gained ~8% worth final week on the again of sturdy Q3 outcomes.

Kimco Realty, or KIM, posted Q3 FFO of $0.41, beats by $0.02. Income of $433.4M (+17.6% Y/Y) beats by $15.98M.

Getty Realty, or GTY, reported Q3 FFO of $0.54, beats by $0.04. SITE Facilities, or SITC, Q3 FFO of $0.29 beats by $0.01, whereas income of $136.19M (+12.5% Y/Y) beats by $2.66M.

Retail Alternative Investments, or ROIC, additionally posted a beat in income.

REITs have posted stable outcomes amid an in any other case disappointing earnings season for the broader fairness market, in response to Looking for Alpha writer Hoya Capital.

Earnings season remains to be younger for the retail sector, however outcomes to this point have been fairly stable, the writer mentioned.

Can SPG proceed the successful streak for retail REITs?

SPG’s consensus FFO estimate is $2.92 and consensus income estimate is $1.27B.

With a good wind path for retail REITs, the upward pattern is unlikely to be discontinued.

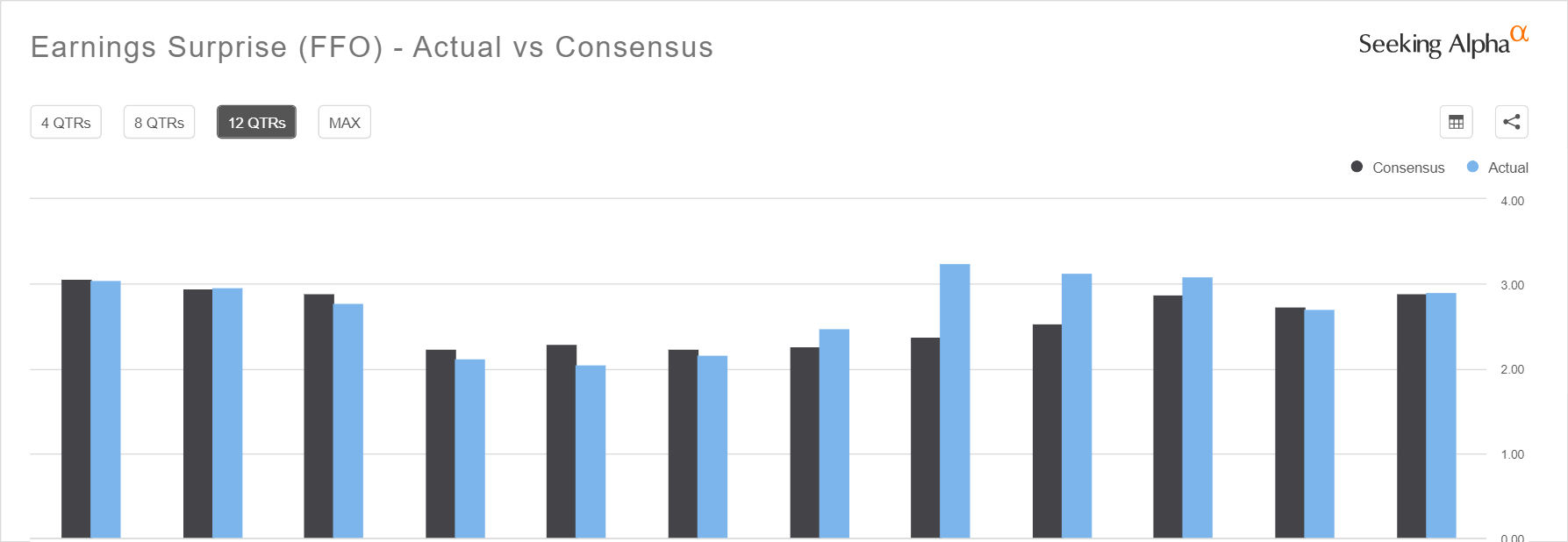

During the last 2 years, SPG has seen FFO beat estimates 63% of the time and income beat estimates 75% of the time. Here’s a take a look at the final 12 quarters:

Hey there, fellow landscaping enthusiast! If you're dreaming of transforming your mountain view property into…

One X Go betting is a modern twist on traditional sports betting, combining the excitement…

When it comes to demolition services in Tampa, Florida, there's a lot to consider. Whether…

Hey there! If you've ever found yourself tangled in the complex web of staffing for…

In the rapidly evolving digital marketing landscape, finding content creators who authentically represent your brand…

Before diving into the specifics, it's important to understand what a demolition contractor does. These…