September’s CPI more likely to present ‘stickier’ prices rising extra, economists say

[ad_1]

pcess609/iStock by way of Getty Photographs

Economists count on headline client inflation to rise 8.1% Y/Y in September, easing from the 8.3% tempo in August, when the Client Value Index report is launched on Thursday. In the meantime, core CPI, which strips out risky meals and power costs, is anticipated to climb 6.5% Y/Y, sooner than the 6.3% enhance within the prior month.

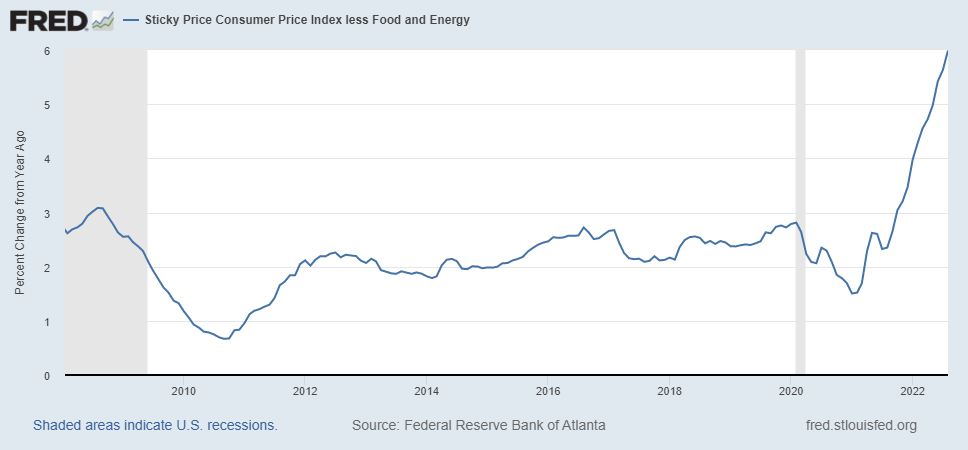

The economists count on the core quantity to outpace the headline quantity as a result of the core CPI contains issues like the fee lease or providers, resembling well being care, which might be “stickier.” As soon as they go up, they are not more likely to go down.

Undesirable guests: Bankrate Senior Financial Analyst Mark Hamrick expects Y/Y CPI progress to remain elevated by the remainder of the yr. “There was aid from excessive gasoline costs which are inclined to worsen customers probably the most, however elevated meals and shelter costs seem like sticking round for some time as undesirable guests,” he mentioned.

Whereas the core private consumption expenditure index (“PCE”) is the Federal Reserve’s most popular inflation gauge, the central bankers don’t ignore the PCI quantity.

“The Fed might be trying on the month-over-month % change in core CPI,” José Torres, senior economist at Interactive Brokers advised In search of Alpha. “Sticky and price-resistant classes the place as soon as value will increase are registered, value decreases are laborious to come back by. Meals away from dwelling, shelter, transportation providers and medical providers might be prime of thoughts.”

September’s CPI is anticipated to extend 0.2% M/M, up from 0.1% in August. The consensus for core CPI is 0.4% M/M, down from 0.6% within the earlier month.

Main indicator? Wednesday’s Producer Value Index might give buyers a clue of what to anticipate for the CPI, mentioned Tuan Nguyen, an economist at RSM US, who analyzes high-frequency financial information

“In two of the previous three stories, a higher-than-expected CPI quantity was registered after producer costs got here in above expectations,” Nguyen mentioned.

The PPI enhance “was consistent with our expectation for a robust rebound of the general financial system within the third quarter, which is able to most definitely develop by greater than 2%,” Nguyen added. The PPI numbers will not dissuade the Fed from its hawkish fee coverage, he added.

Bears able to rally? Interactive Brokers’ Torres expects that any indication that costs are easing will lead result in elevated stock-investing. “The market is oversold and the burden of proof has shifted to the bears,” he mentioned..” Any reasonable to constructive information on the CPI entrance, even in-line outcomes, a deceleration in providers, rents, or good costs, can produce the subsequent bear market rally.”

In the meantime, SA contributor Logan Kane appears to be like to a Cleveland Fed econometric mannequin, which expects core CPI to rise 0.51% M/M in September and 0.53% in October. “If these projections are proper, these numbers are dangerous and worse than the market expects, exhibiting that the Fed is nowhere close to stopping inflation and {that a} laborious touchdown is the one means down,” Logan wrote Wednesday.

Source link