[ad_1]

Betterment, a roboadvisory platform which manages over $33 billion in property, has lastly launched its crypto providing after finishing a non-public beta part. The fintech acquired Makara, a crypto asset administration startup, again in February and has been working in the direction of reworking Makara into its personal in-house crypto product for the reason that deal closed.

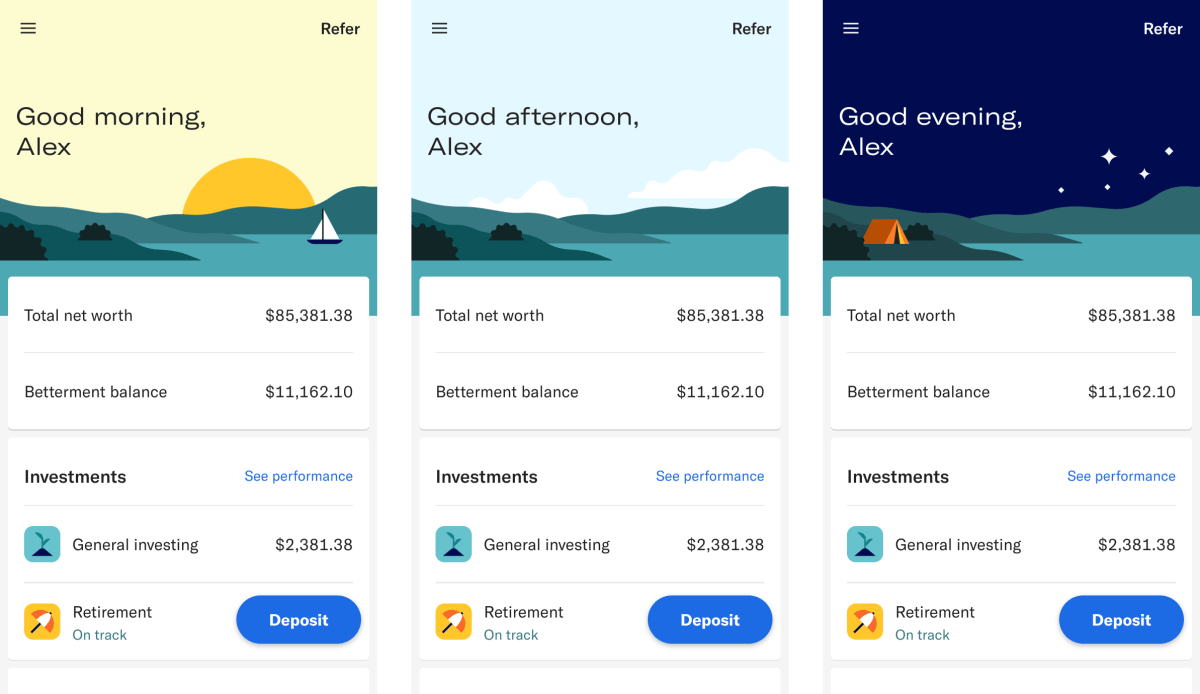

Crypto for Betterment, as the brand new providing is named, debuts to Betterment’s 730,000+ prospects at present with 4 themed, customizable portfolios that can enable customers to put money into curated picks of digital property, the corporate’s VP of crypto, Jesse Proudman, instructed TechCrunch in an interview.

In accordance with Proudman, the 4 portfolios that launched at present embrace roughly 25 completely different cryptocurrencies every and categorized as follows:

Proudman famous that the providing will embrace a function that guides customers to restrict their crypto publicity to five% of their investable property as a guardrail.

“A fairly significant variety of our shoppers are both or already invested [in crypto], however they’re feeling stress with the do-it-yourself nature, significantly once you couple that with the velocity of change that occurs on this asset class. In order that they supplied suggestions that this form of managed, curated providing was of curiosity to them,” Proudman stated.

Makara, which is registered with the U.S. Securities and Alternate Fee, launched with 20,000 prospects and $1 million in property beneath administration final June, in line with Decrypt.

Betterment introduced final month that it will be partnering with crypto change Gemini, helmed by the Winklevoss twins, to develop the crypto portfolios and function custodian for the property. The corporate’s final publicly-known fundraise was a $160 million spherical introduced in September final 12 months, which it raised at a $1.3 billion valuation.

The corporate has been comparatively gradual in comparison with different funding platforms like Robinhood and Acorns in including crypto to its suite, maybe partly as a result of it desires to give attention to messaging across the significance of long-term investing, particularly because the crypto markets proceed to show risky. Betterment’s launch comes only a week after investing app Stash introduced its personal crypto providing knowledgeable by an anti-trading, long-term ethos that stands in distinction to the short-term buying and selling mentality usually related to Robinhood’s rise.

Hey there, gaming enthusiasts! If you're on the hunt for the following popular trend in…

Understanding the Principles Before we get into the nitty-gritty, let's start with the basics. Precisely…

At its core, a vacuum pump is often a device that removes natural gas molecules…

For anyone in Newcastle-under-Lyme, getting around efficiently and comfortably often means relying on a taxi…

Before we get into the nitty-gritty of their benefits, let's first clarify what Modus Carts…

Delta 10 is often a cannabinoid found in trace volumes in the cannabis plant. It…