[ad_1]

iloliloli/iStock by way of Getty Photographs

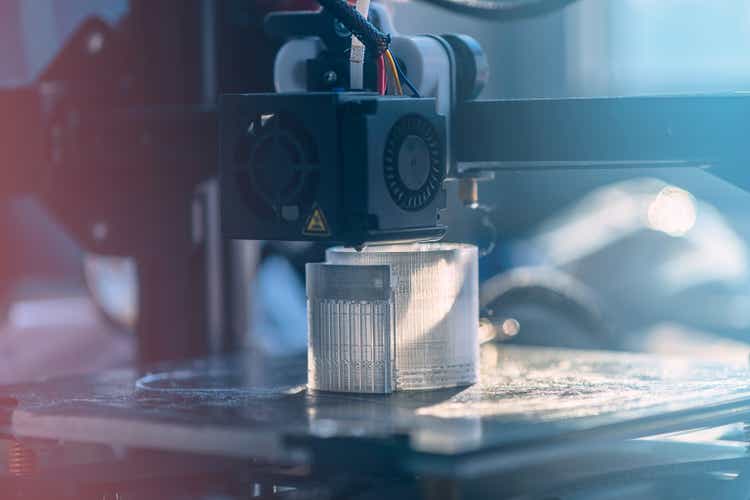

Proto Labs (NYSE:PRLB) inventory sank 24% to its lowest in over a decade on Friday after the digital manufacturing firm offered This fall steering that broadly missed estimates.

The agency expects This fall adj. EPS of $0.18-$0.26 vs. consensus estimate of $0.43.

This fall income is anticipated to be $107M-$115M vs. consensus estimate of $126.02M.

Proto Labs (PRLB) projected international foreign money to have an ~$4.2M unfavorable impression on This fall income, whereas closure of Japan operations is anticipated to have an ~$3.5M opposed impression.

The corporate reported Q3 adj. EPS of $0.40 vs. $0.35, pushed by Hubs gross margin enchancment and a decrease efficient tax charge.

However income fell 2.9% Y/Y to $121.72M, damage by continued softening of its largest enterprise – injection molding.

Injection molding income fell 15.2% to $48.9M.

Protolabs (PRLB) served 23,816 distinctive product builders through the Q3.

“Our monetary place stays robust as we produced $20.5M in money from operations within the quarter. As we monitor the economic system, we’re tightening our price controls,” stated CFO Dan Schumacher.

Shares of Proto Labs (PRLB) dropped ~49% YTD.

Proto Labs (PRLB) is at excessive danger of performing badly as a result of destructive EPS revisions and decelerating momentum, in line with SA Quant ranking system.

Hey there, gaming enthusiasts! If you're on the hunt for the following popular trend in…

Understanding the Principles Before we get into the nitty-gritty, let's start with the basics. Precisely…

At its core, a vacuum pump is often a device that removes natural gas molecules…

For anyone in Newcastle-under-Lyme, getting around efficiently and comfortably often means relying on a taxi…

Before we get into the nitty-gritty of their benefits, let's first clarify what Modus Carts…

Delta 10 is often a cannabinoid found in trace volumes in the cannabis plant. It…