[ad_1]

(Bloomberg) — The battering of bonds this 12 months from inflation and better charges has made long-term municipal securities so low cost that buyers who normally shun them could also be patrons.

Most Learn from Bloomberg

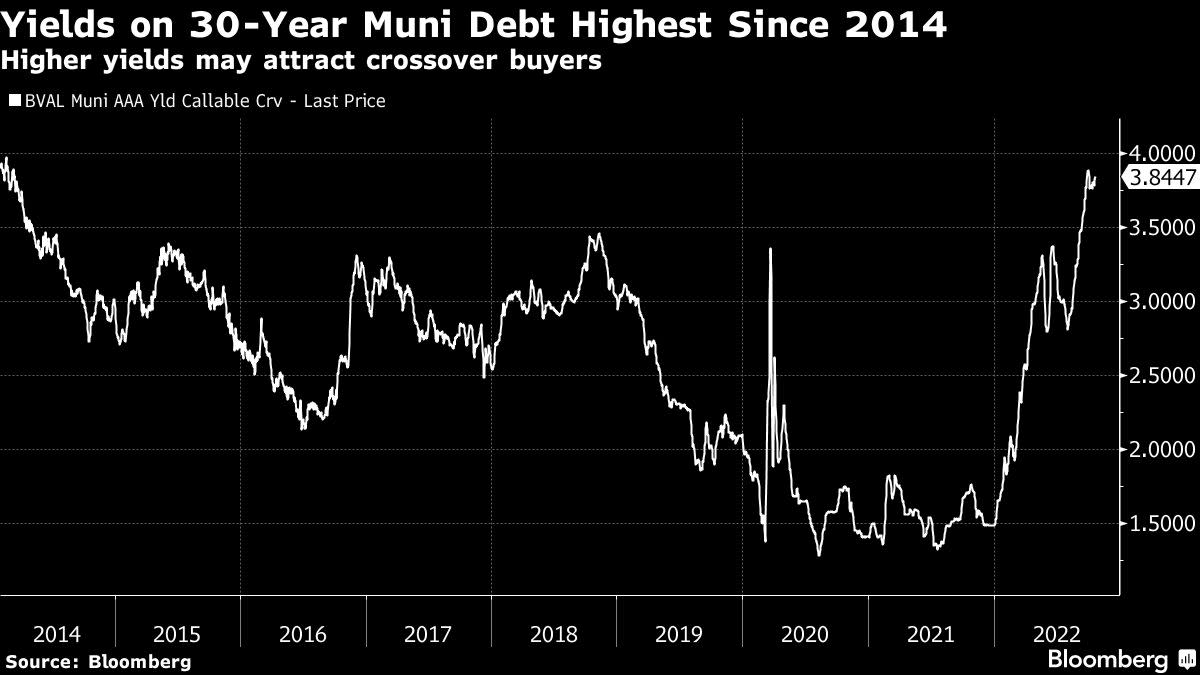

The yield on tax-exempt municipal debt maturing in 30 years reached 3.8% on Thursday, close to its highest since March 2014, in keeping with knowledge compiled by Bloomberg.

That’s virtually 92% of the speed on 30-year US Treasuries, larger than the standard ratio for tax-exempt to taxable debt, that means the municipal bonds are comparatively low cost. And the creditworthiness of state and metropolis securities has benefited from strong tax receipts and federal pandemic aid, making them extra compelling to a wider vary of buyers, stated Paul Malloy, head of municipal funding at Vanguard Group Inc.

“Collectively it actually does make municipals look to be one of the engaging components of the fixed-income market at the moment, significantly on the lengthy finish,” Malloy stated.

Yields on each new and outdated muni bonds have risen because the Federal Reserve raised rates of interest to sluggish the quickest inflation in many years. Costs within the secondary market dropped, producing a lack of 11.5% to date this 12 months for the broader municipal-bond market, in keeping with Bloomberg Barclays Indexes.

Tax-exempt securities maturing in 22 years or longer are the worst-performing a part of the muni curve, dropping 18.9% by way of Oct. 19, in keeping with the indexes.

However Vanguard’s Malloy anticipates a bounce again, with demand from so-called crossover patrons who deal with company and US Treasury securities serving to to boost muni bond costs, which transfer inversely from yields.

“One of many foremost traits of the muni market is it can snap again and it’ll snap again laborious when it does,” Malloy stated.

Some municipal market members additionally see help coming from the Fed down the highway, when the central financial institution inevitably slows its rate-rise regime. Buyers in longer-dated securities ought to lengthen their portfolio period, however in a disciplined trend, in keeping with a Financial institution of America Corp. municipal analysis report dated Oct. 14.

“We see that the strongest returns have a tendency to come back on lengthy maturity indexes between the second-to-last and final charge hike,” in keeping with the Financial institution of America report.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.

In the rapidly evolving digital marketing landscape, finding content creators who authentically represent your brand…

Before diving into the specifics, it's important to understand what a demolition contractor does. These…

Hey there! If you're cruising around Arlington and suddenly find your windshield cracked or shattered,…

Hello there! If you're searching for the top asphalt paving companies in Indiana, you're in…

Hey there! If you've ever driven on a smooth, sleek road and thought, "Wow, this…

Hello, enterprising souls of Anaheim! Are you eager to breathe new life into your commercial…