Moderna Inc. shares plunged 11% in premarket commerce Thursday, after the COVID vaccine maker posted far weaker-than-expected third-quarter earnings and lowered full-year gross sales steerage by as much as $3 billion.

The Cambridge, Mass.-based biotech

MRNA,

-3.88%

posted internet revenue of $1.043 billion, or $2.53 a share, for the quarter, down from $3.333 billion, or $7.70 a share, within the year-earlier interval. Income fell to $3.364 billion from $4.969 billion a yr in the past.

Each numbers had been under the FactSet consensus, which known as for EPS of $3.30 and income of $3.527 billion.

The corporate stated superior buy agreements, or APAs, for supply this yr are actually anticipated to whole $18 billion to $19 billion of product gross sales, down from steerage of $21 billion that it offered when it reported second-quarter earnings. The FactSet consensus is for full-year gross sales of $21.3 billion.

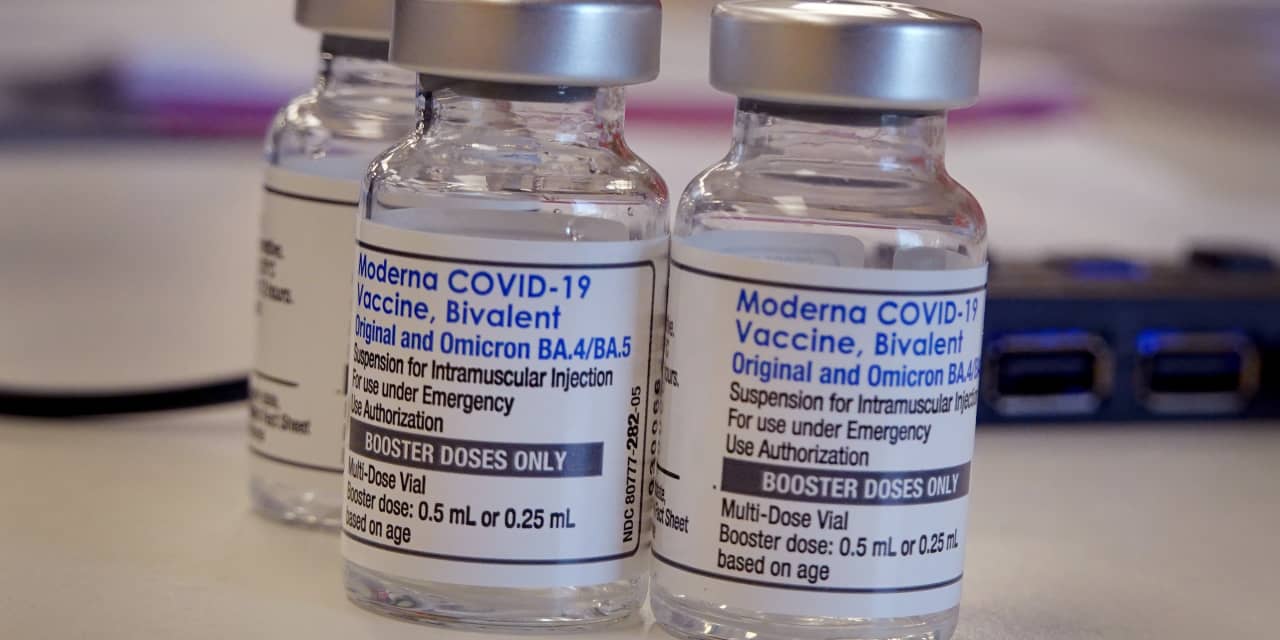

Moderna’s COVID vaccine is its first accredited product, though it has 48 packages in improvement throughout 45 improvement candidates, 35 of that are in lively trials.

Key trials embody vaccines aimed toward flu and respiratory syncytial virus, or RSV, a seasonal sickness that has hit younger youngsters within the U.S. particularly exhausting this yr and crammed hospitals and emergency rooms. The corporate expects a knowledge readout on these within the first quarter of 2023.

Learn now: COVID-19 could also be responsible for the surge in RSV sickness amongst youngsters. Right here’s why.

Additionally: Consultants are warning of potential ‘tripledemic’ this winter as COVID, flu and now RSV flow into

The corporate can also be engaged on a customized most cancers vaccine together with Merck’s

MRK,

-0.36%

Keytruda.

Moderna stated its third-quarter income was damage by a decline in gross sales of the COVID vaccine, in addition to decrease gross sales quantity as a result of timing of market authorizations for its bivalent COVID booster and the associated manufacturing time ramp-up.

Price of gross sales got here to $1.1 billion, or 35% of product gross sales, together with a $333 million cost for stock write-downs regarding COVID merchandise that exceeded their shelf life previous to getting used. The corporate additionally took an expense on unused manufacturing capability of $209 million and a lack of agency buy commitments and associated cancellation cost of $102 million, pushed by a shift in product demand to the bivalent booster.

For 2023, the corporate has APAs of $4.5 billion to $5.5 billion. The FactSet consensus for 2023 gross sales is for $9.4 billion.

Shares have fallen 42% within the yr up to now, whereas the S&P 500

SPX,

-2.50%

has fallen 21%.