Kinder Morgan preview: Will pipeline development drive Q3 earnings beat?

[ad_1]

krblokhin/iStock Editorial by way of Getty Photographs

Kinder Morgan (NYSE:KMI) is scheduled to announce Q3 outcomes on Wednesday, Oct. 19, after market shut.

The consensus EPS estimate is $0.29 (+31.8% Y/Y) and consensus income estimate is $4.56B (+19.4% Y/Y).

Over the final 2 years, KMI has crushed EPS estimates 88% of the time and income estimates 100% of the time.

Over the past 3 months, EPS estimates have seen 4 upward revisions and three downward. Income estimates have seen 6 upward revisions.

Goldman Sachs upgraded Kinder Morgan (KMI) to Impartial because it expects its pipeline development to drive earnings and enhance free money movement.

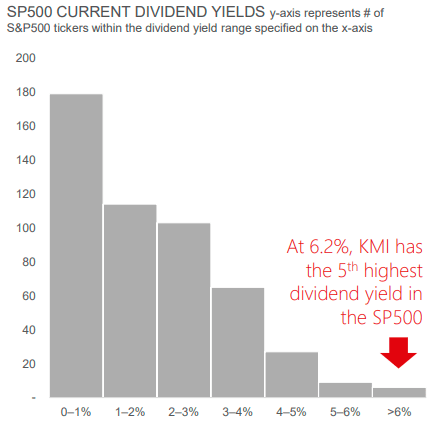

SA contributor Daniel Thurecht in a bullish evaluation highlighted the midstream operator’s excessive dividend yield, saying its outlook sees a stable base for steadily rising free money movement and steadily declining leverage. In accordance with the agency’s newest investor replace:

Kinder Morgan (KMI) rose after it posted Q2 adj. earnings barely above estimates and raised its FY steering, on the again of stronger-than-expected commodity costs and favorable outcomes from its pure gasoline pipelines and CO2 enterprise.

Current information:

- Kinder Morgan (KMI) bought a 25.5% stake in Elba Liquefaction to an undisclosed purchaser for ~$565M, which suggests an enterprise worth of $2.3B for Elba.

- The pipeline operator acquired North American Pure Assets and its landfill gas-to-power services for $135M.

Shares of KMI gained 7.7% YTD, however declined 4% over the past 1 yr, underperforming the S&P 500 Vitality index.

Source link