GTA views the October low as a short- & intermediate-bottom

[ad_1]

franckreporter

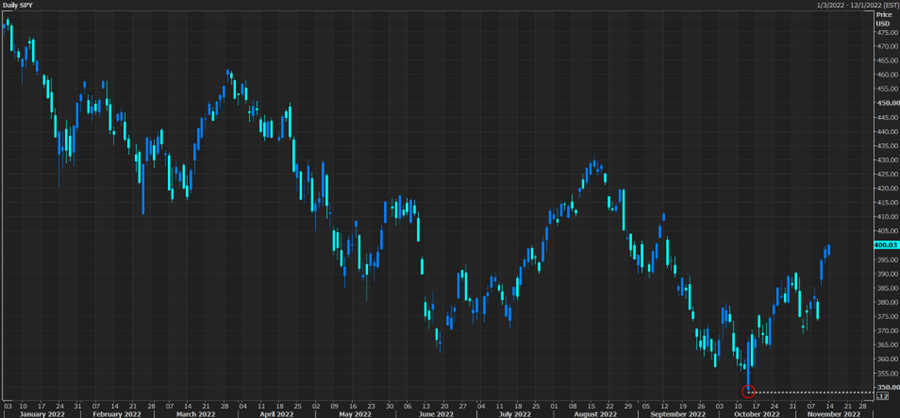

The October buying and selling low within the S&P 500 had marked a key technical level for brief time period ranges, however based on World Pattern Alert the October low deal with is now an intermediate backside degree as properly.

GTA outlined in a latest investor observe: “After the market reached an especially oversold degree in mid-October, we felt very strongly that an essential short-term backside had been put into place. And for this reason, since then, we’ve repeatedly confused that the possibilities favor that these October thirteenth lows gained’t be violated any time quickly.”

The report continued with: “We now really feel that these October lows weren’t solely essential brief time period bottoms, however have been additionally intermediate time period in nature.”

Furthermore, GTA highlighted that additionally they have lessened to the impact their shorting positions as they said that: “We might not do new shorting, and would as a substitute look to do aggressive lowering in shorts.”

Since Wall Road dropped to it 2022 low on October 13th, it has since rallied 14.4% and crossed above its 100-day transferring common.

See a under chart of the October 13th low that the S&P 500 (SP500) and its mirroring (NYSEARCA:SPY) alternate traded fund are referenced to.

In broader monetary information, Wall Road’s main indices had made modest positive factors in a risky buying and selling session on Monday.

Source link