[ad_1]

(Bloomberg) — Goldman Sachs Group Inc. and BlackRock Inc. are turning extra bearish on equities for the quick time period, warning that markets are but to cost within the danger of a world recession.

Most Learn from Bloomberg

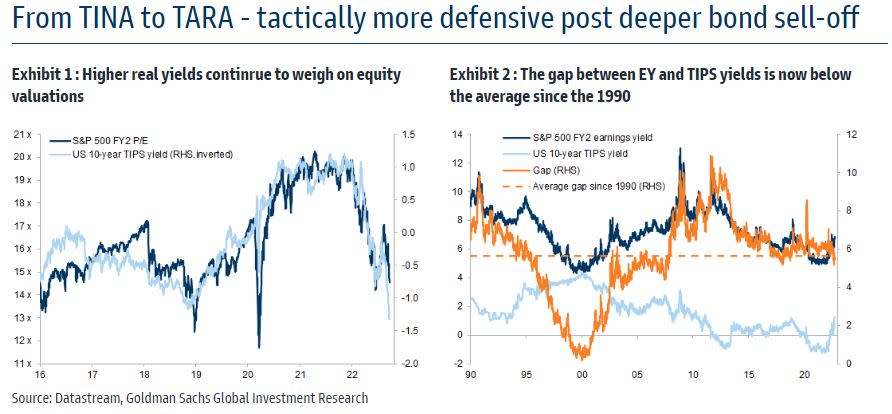

Flagging rising actual yields as a significant headwind, Goldman strategists minimize equities to underweight within the US funding financial institution’s world allocation over the subsequent three months whereas staying obese money. BlackRock is advising traders to “shun most shares,” including that it’s tactically underweight developed-market shares and prefers credit score within the quick time period.

“Present ranges of fairness valuations might not totally replicate associated dangers and may need to say no additional to achieve a market trough,” Goldman strategists together with Christian Mueller-Glissmann wrote in a be aware Monday. Goldman’s market-implied recession likelihood has risen to above 40% following the current bond sell-off, “which traditionally has indicated elevated fairness drawdown danger,” they wrote.

Comparable issues are being echoed by Morgan Stanley and JPMorgan Asset Administration after central bankers from the US to Europe touted their resolve to combat inflation, sending world shares right into a free fall over the previous few days. Little respite appears to be in sight even because the MSCI World Index’s members have misplaced greater than $8 trillion in worth since a mid-September peak amid a surge in US yields and the greenback.

READ: Throw-in-Towel Second Is But to Come Even After Inventory Selloff

“We don’t see a ‘tender touchdown’” the place inflation returns to focus on shortly with out crushing exercise, BlackRock Funding Institute strategists together with Jean Boivin and Wei Li wrote in a be aware Monday. “Meaning extra volatility and stress on danger belongings.”

TINA to TARA

As inventory market volatility continues to rise, JPMorgan Asset can be sticking to its underweight on equities heading into the fourth quarter. The agency ‘strongly’ favors investment-grade credit score over excessive yield, Sylvia Sheng, world multi-asset strategist, wrote Tuesday, anticipating sluggish progress within the US and recession in Europe over the subsequent 12 months.

A world recession likelihood mannequin by Ned Davis Analysis lately rose above 98%, triggering a “extreme” recession sign. The one different occasions it has been that prime was throughout earlier acute downturns, similar to in 2020 and 2008-2009, based on the agency.

The times of the TINA — There Is No Various — mantra for shares are over, the Goldman strategists wrote. Whereas falling yields had burnished the enchantment of equities because the world monetary disaster, “traders at the moment are dealing with TARA (There Are Affordable Alternate options) with bonds showing extra enticing,” they wrote.

Goldman’s bearish take comes after its US strategists slashed their year-end goal for the S&P 500 Index to three,600 from 4,300 final week. Equally, Europe strategists together with Sharon Bell have diminished targets for regional fairness gauges, downgrading their 2023 earnings-per-share progress forecast for the Stoxx Europe 600 Index to -10% from zero.

Each the S&P 500 and Stoxx Europe 600 ended Monday’s session at their lowest ranges since December 2020.

“This bear market has not but reached a trough,” Bell and her colleagues wrote about European shares in a separate be aware Monday.

(Updates with views of BlackRock, JPMorgan strategists and extra context.)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.

Hey there, fellow landscaping enthusiast! If you're dreaming of transforming your mountain view property into…

One X Go betting is a modern twist on traditional sports betting, combining the excitement…

When it comes to demolition services in Tampa, Florida, there's a lot to consider. Whether…

Hey there! If you've ever found yourself tangled in the complex web of staffing for…

In the rapidly evolving digital marketing landscape, finding content creators who authentically represent your brand…

Before diving into the specifics, it's important to understand what a demolition contractor does. These…