[ad_1]

SimoneN/iStock through Getty Photos

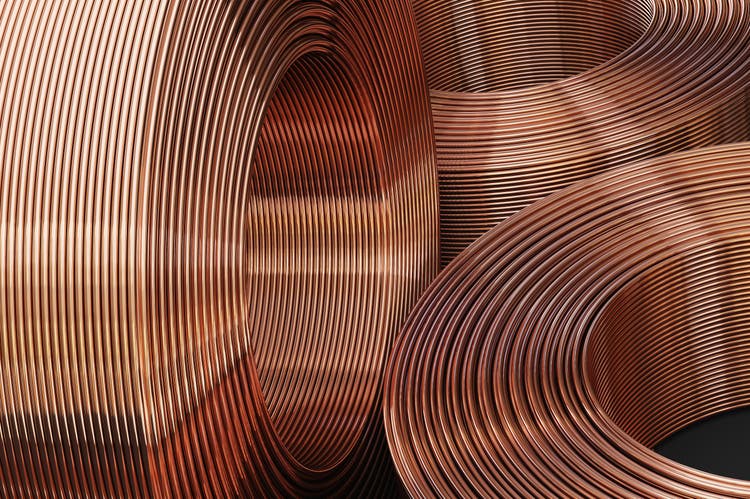

Freeport McMoRan (NYSE:FCX) +7.1% in Thursday’s buying and selling after Q3 adjusted earnings edged previous estimates, whilst revenues fell on account of decrease promoting costs for copper and different metals, and the corporate stated the present bodily copper market is “strikingly tight.”

Q3 internet earnings fell to $404M, or $0.28/share, from $1.4B, or $0.94/share, within the year-earlier quarter, and revenues fell to $5B from $6.08B however topped Wall Avenue estimates.

Freeport (FCX) stated its common realized value for copper was $3.50/lb on the finish of Q3, nicely under final 12 months’s $4.20/lb, however Q3 copper manufacturing elevated 2% Y/Y to 1.06B recoverable lbs from 987M a 12 months in the past.

Q3 consolidated gold gross sales jumped 19% Y/Y to 480K oz, whereas molybdenum gross sales slipped 15% to 17M lbs; common realized costs for gold and molybdenum had been $1,683/oz and $17.05/lb, respectively.

“Present costs for copper are inadequate to assist new mine provide growth, which is predicted so as to add to future provide deficits,” the corporate stated.

Freeport McMoRan’s (FCX) inventory value return reveals a 26% YTD loss and a 21% decline in the course of the previous 12 months.

In the rapidly evolving digital marketing landscape, finding content creators who authentically represent your brand…

Before diving into the specifics, it's important to understand what a demolition contractor does. These…

Hey there! If you're cruising around Arlington and suddenly find your windshield cracked or shattered,…

Hello there! If you're searching for the top asphalt paving companies in Indiana, you're in…

Hey there! If you've ever driven on a smooth, sleek road and thought, "Wow, this…

Hello, enterprising souls of Anaheim! Are you eager to breathe new life into your commercial…