[ad_1]

(Bloomberg) — Tighter Federal Reserve coverage is elevating households’ interest-rate burden, resulting in a speedy decline in extra financial savings and underscoring the chance hawkishness has peaked.

Most Learn from Bloomberg

The pandemic rise in extra financial savings was most likely essentially the most speedy improve in wealth ever seen. A mix of a collapse in demand and large authorities transfers led to an estimated peak of $2.3 trillion in extra financial savings being collected by the center of 2021.

However after the feast comes the famine, and extra financial savings are being run down swiftly as inflation causes costs and rates of interest to rise. These extra financial savings act as a buffer to a recession as they dampen the suggestions loop of a decline in spending, resulting in a fall in revenue, which suggests much less spending, and so forth.

The Bureau of Financial Evaluation defines the move of financial savings as disposable private revenue – consumption – different outlays. The private financial savings price is the distinction between disposable revenue and consumption as a share of disposable revenue. The financial savings price reached as excessive as 33% within the depths of a the pandemic – a beforehand unimaginable stage – however since then has collapsed to a close to all-time low of three.1%.

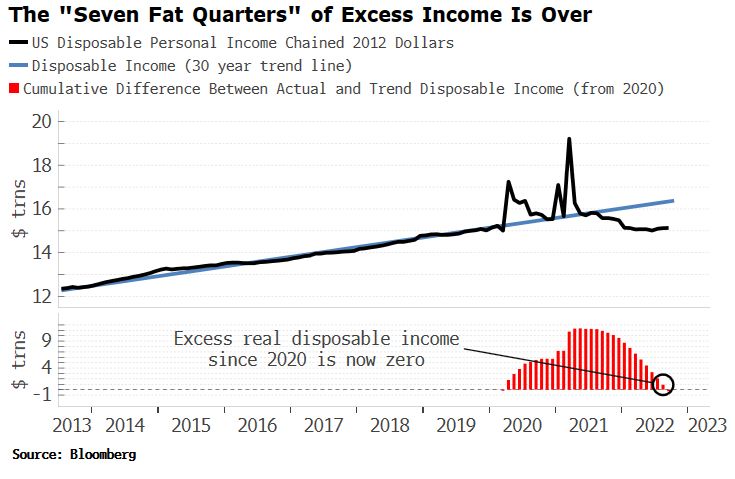

The dissaving could be seen within the speedy decline in “extra disposable revenue,” i.e. disposable revenue above its pre-pandemic pattern. It’s again to flat primarily based on a 30-year pattern line, signifying that extra financial savings are not being bolstered by extra revenue as a result of individuals are spending extra and pandemic-related switch funds from the federal government have ceased.

Financial savings are being more and more confused by rising debt repayments. Shopper and mortgage debt rates of interest are rising. Debt-service ratios (debt repayments as a share of disposable revenue) stay comparatively low, however are additionally rising, and will accomplish that pretty quickly as debt is re-fixed at larger charges.

MLIV Pulse: Do you suppose buyers are too bullish or too bearish about property subsequent 12 months? Fill out our MLIV Pulse survey right here.

In nominal phrases, households must repay an estimated $1.75 trillion annually, or virtually 10% of disposable revenue. This burden will worsen as extra revenue is eaten up by rising costs.

The Fed estimates that extra financial savings have dwindled to $1.7 trillion (as of mid-2022), a 26% drop in a 12 months. The inventory of extra financial savings is prone to fall with an rising tempo because the lagged results of rising rates of interest chunk.

The recession buffer is being worn out, leaving the US economic system in a extra fragile place and elevating the chance the Fed has reached its peak in bellicosity on the conflict on inflation (for now).

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.

In the rapidly evolving digital marketing landscape, finding content creators who authentically represent your brand…

Before diving into the specifics, it's important to understand what a demolition contractor does. These…

Hey there! If you're cruising around Arlington and suddenly find your windshield cracked or shattered,…

Hello there! If you're searching for the top asphalt paving companies in Indiana, you're in…

Hey there! If you've ever driven on a smooth, sleek road and thought, "Wow, this…

Hello, enterprising souls of Anaheim! Are you eager to breathe new life into your commercial…