Fed can dwell with S&P 4,500 with stage set for a powerful rally

[ad_1]

niphon

Shares have been “obliterated” and the latest inventory features seem like greater than a easy bear-market rally, Fundstrat Tom Lee says.

For a lot of 2022 the consensus seemed to be a drop within the S&P 500 (SP500) (NYSEARCA:SPY) to three,200. However investor notion of threat is not one-sided, with inflation pressures easing and the Fed turning into extra information dependent, Lee wrote in a be aware.

The S&P “is down -20% in nominal phrases, however down -28% on ‘actual phrases’ (CPI adjusted),” Lee stated. “The Fed has received. Shares have been obliterated.”

“However this additionally means a 50% rally in equities would nonetheless go away shares -15% on a ‘actual foundation’ – in different phrases, S&P 500 4,500 would nonetheless be in step with Fed’s targets of tightening monetary circumstances.”

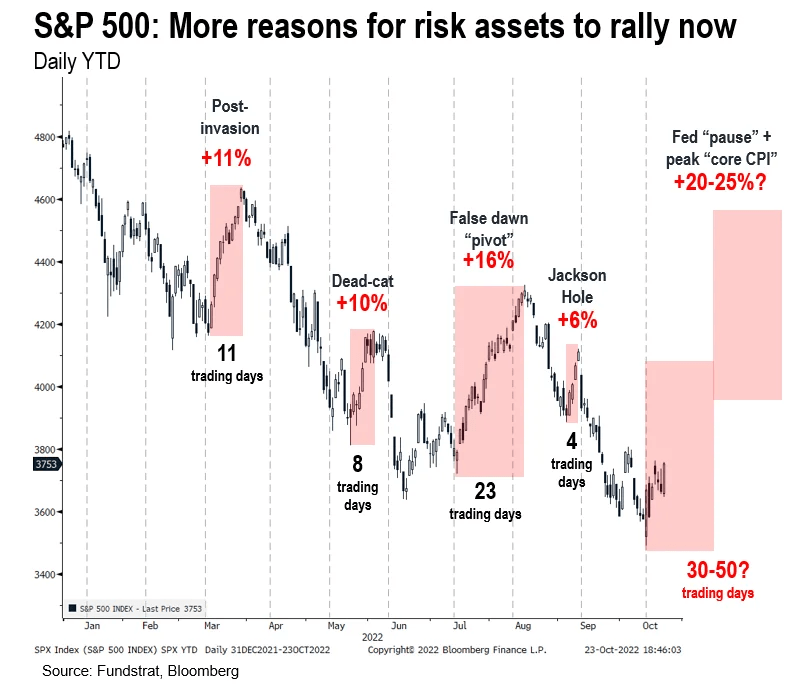

Even “if this proves to be a ‘bear rally,’ the substances are in place for a rally far stronger than the “June pivot hopes” rally, which lasted 23 buying and selling days and rose +16%,” Lee added.

In the course of the June pivot rally, solely headline CPI had peaked, whereas JOLTs confirmed openings/employees at about 2. Now that ratio is 1.67 and falling, whereas extra economists are calling for “substantial declines” in core CPI, Lee famous.

As well as, “investor positioning is way extra bearish now than anytime in 2022.”

“Taken collectively: doesn’t it make sense a rally ought to exceed the ‘false daybreak pivot’?,” Lee stated, including, “contemplate a doable 30-50 day rally and 20-25%?”

The one “fly within the ointment” is the continued surge in 10-year yields (US10Y) (TBT) (TLT).

BofA shopper flows present traders persevering with to pile into single shares.

Source link