[ad_1]

(Bloomberg) — Credit score Suisse Group AG is struggling to revive confidence in its battered model, with buyers to date displaying little optimism that final month’s technique revamp will succeed after years of scandals and mismanagement.

Most Learn from Bloomberg

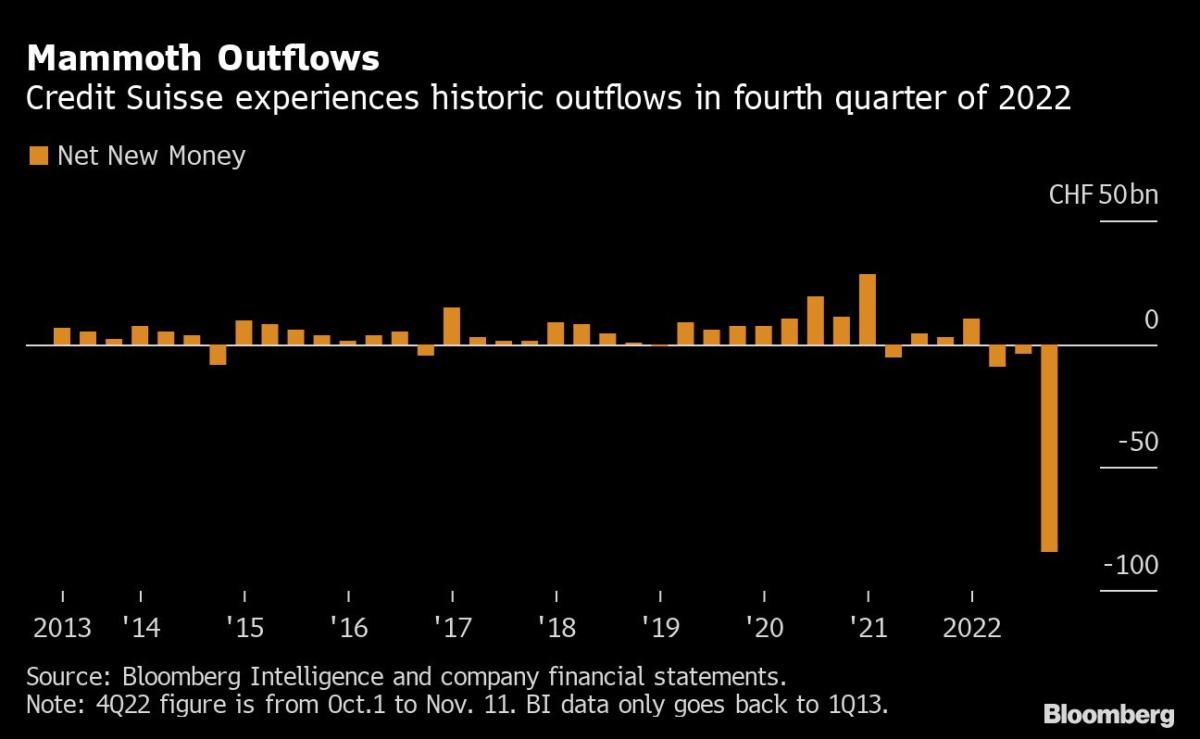

The next charts present three fronts crucial for the Zurich-based financial institution’s turnaround — and on all, the financial institution continues to face problem. The share value hit an all-time low Tuesday, the price of default insurance coverage is spiking once more, and the rich purchasers the lender depends on proceed to tug out their cash.

Learn Extra: Credit score Suisse Noticed $88 Billion Outflows as Confidence Slumped

With one other loss looming for the ultimate quarter of the yr and a $4 billion capital increase below means that dilutes the holdings of current shareholders, Credit score Suisse is relying on the persistence of buyers and workers as the advantages of restructuring take time to reach. Chief Government Officer Ulrich Koerner has set 2024 because the yr the financial institution will “undoubtedly” be worthwhile once more.

Credit score Suisse shares opened increased Wednesday after hitting a low of two.90 Swiss francs ($3.0417) on Tuesday, with the shares on observe for his or her longest dropping streak since October 2007. The inventory has fallen 18% because the financial institution introduced huge outflows from wealth-management purchasers final week. The downward pattern means Credit score Suisse is now not Switzerland’s second-largest financial institution by market capitalization, slipping behind wealth supervisor Julius Baer Group Ltd.

The present drop is nevertheless additionally being influenced by the continued capital increase through rights situation. The primary day of buying and selling for the brand new shares is predicted to be Dec. 9, doubtlessly assuaging a number of the downward strain on the shares.

Downgrades of Credit score Suisse debt by rankings firms have been weighing on prospects’ consolation ranges in doing enterprise with the financial institution. They’ve additionally raised the price of borrowing, and the worth buyers pay for insurance coverage in opposition to default. Credit score default swaps for the financial institution’s senior debt had already risen to the best because the monetary disaster in early October amid persistent rumors over the financial institution’s stability, and hit one other file on Tuesday.

Learn Extra: Credit score Suisse Reduce to One Degree Above Junk Standing by S&P

The financial institution issued a US bond yielding over 9% in early November, in addition to a euro bond paying a coupon of just under 8%. The speed was the second-highest ever for a brand new senior investment-grade financial institution deal in euros.

Learn Extra: Credit score Suisse Compelled to Pay Junk-Degree Yields for Money Infusion

The phrases might proceed to worsen if Credit score Suisse receives one other credit standing downgrade as two companies — Moody’s and Fitch — have unfavourable outlooks on the financial institution, with each at present placing it two notches above junk. A downgrade may very well be triggered if it might probably’t stem the shopper outflows, Moody’s stated in a ranking determination earlier this month.

Credit score Suisse is on a marketing campaign to rebuild belief within the wake of the outflows. Executives stated final week that the withdrawals from wealth administration have stabilized however not reversed since October.

However, lots of of rich prospects in Asia have sought to position their funds with rival Swiss lender UBS Group AG within the area amid the turmoil, and the financial institution is planning to re-allocate workers to deal with these increasing accounts, folks aware of the matter earlier instructed Bloomberg. Morgan Stanley can also be amongst banks benefiting from the historic outflows at Credit score Suisse.

–With help from Jan-Patrick Barnert and Allegra Catelli.

(Updates with shares)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.

Hey there, fellow landscaping enthusiast! If you're dreaming of transforming your mountain view property into…

One X Go betting is a modern twist on traditional sports betting, combining the excitement…

When it comes to demolition services in Tampa, Florida, there's a lot to consider. Whether…

Hey there! If you've ever found yourself tangled in the complex web of staffing for…

In the rapidly evolving digital marketing landscape, finding content creators who authentically represent your brand…

Before diving into the specifics, it's important to understand what a demolition contractor does. These…