Can Regeneron keep EPS beat run in Q3 as eye care house heats up?

[ad_1]

Mongkol Onnuan

Regeneron Prescribed drugs (NASDAQ:REGN) is scheduled to announce Q3 earnings outcomes on Thursday, November third, earlier than market open.

The consensus EPS Estimate is $9.62 (-37.4% Y/Y) and the consensus Income Estimate is $2.86B (-17.1% Y/Y).

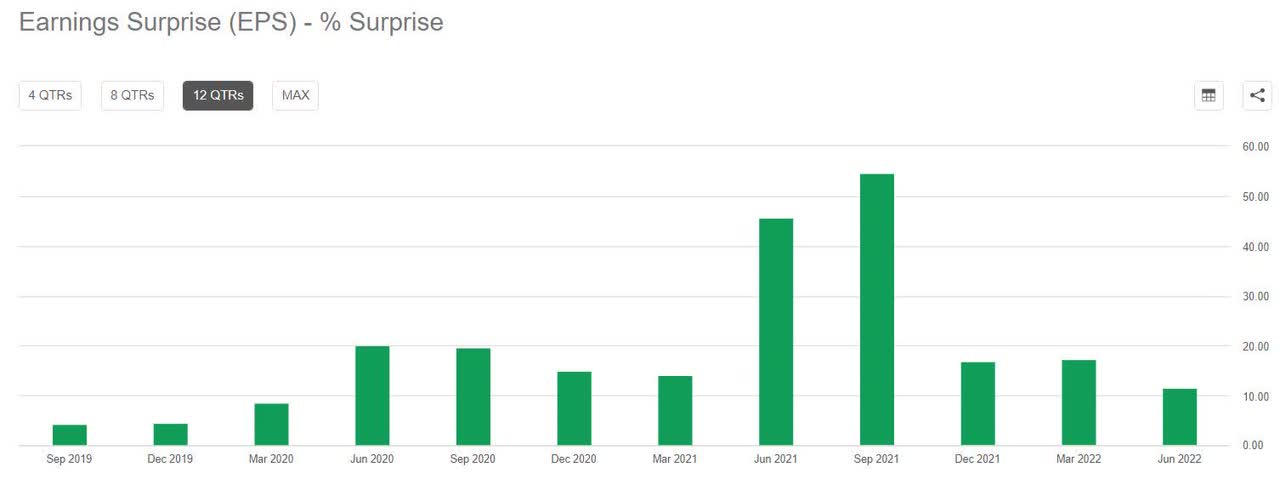

During the last 2 years, REGN has crushed EPS estimates 100% of the time and has crushed income estimates 88% of the time.

During the last 3 months, EPS estimates have seen 4 upward revisions and 12 downward. Income estimates have seen 7 upward revisions and eight downward.

The corporate’s inventory rose +5.88% on Aug. 3 after Q2 outcomes beat analysts estimates. Nonetheless, Regeneron income slipped ~44% Y/Y to $2.9B as gross sales from COVID-19 antibody remedy REGEN-COV dried up. Gross sales of Dupixent, which is developed with French drugmaker Sanofi, did assist offset the affect by including $2.09B of web product gross sales globally with +40% Y/Y development.

Sanofi, which reported Q3 outcomes final week, famous that gross sales of Dupixent elevated +64.1% Y/Y (+44.5% at CER) to €2.31B.

Eylea, which is marketed in partnership with Bayer, generated U.S. web gross sales of $1.62B in Q2, up +14% Y/Y.

In October, Regeneron was downgraded by Evercore ISI citing the necessity for readability over the corporate’s prospects in ophthalmology led by Moist AMD remedy Eylea.

Just lately, Roche reported outcomes from two part 3 trials by which Vabysmo matched Eylea to deal with a kind of imaginative and prescient dysfunction.

Regeneron, nonetheless, has been making efforts to develop the indication for Eylea and in October obtained precedence assessment from the FDA for the drug to deal with Retinopathy of Prematurity in preterm infants.

Source link