Can greater manufacturing assist increase Vale’s Q3 efficiency regardless of weaker costs? (NYSE:VALE)

[ad_1]

Dazman/E+ through Getty Photographs

Vale (NYSE:VALE) is scheduled to announce Q3 earnings outcomes on Thursday, October twenty seventh, after market shut.

The consensus EPS Estimate is $0.55 and the consensus Income Estimate is $10.16B (-19.9% Y/Y).

Over the past 3 months, EPS estimates have seen 0 upward revisions and 4 downward. Income estimates have seen 0 upward revisions and three downward.

The miner mentioned its Q2 earnings fell sharply from a 12 months earlier, smacked by declining iron ore and copper costs on the finish of the quarter however partially compensated by greater iron ore gross sales. Its common realized iron ore gross sales value fell 31% Y/Y to $113.30/metric ton, whereas free-on-board money prices rose 11% on account of costlier gasoline and exchange-rate swings.

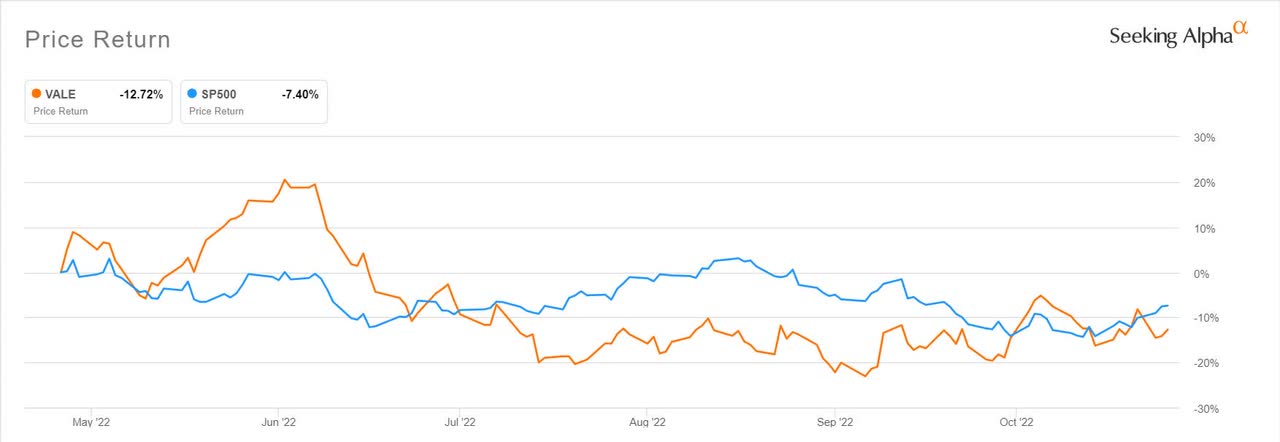

The most recent quarter has seen shares take a tumble amid weak spot in metallic costs. Iron ore costs hit their lowest degree within the 12 months amid a dismal outlook for world metal demand. Copper costs too plummeted to their lowest in practically two months in September, weighed by the sturdy greenback and fears of a recession that will harm demand for industrial metals.

Buyers will look out for steerage amid weak iron and copper costs, regardless of Vale seeing a pickup in manufacturing.

Earlier this month Vale (VALE) reported Q3 iron ore manufacturing rose greater than anticipated whereas nickel output soared as refineries resumed operations. Manufacturing edged up 1.1% Y/Y however jumped 21% Q/Q to 89.7M metric tons and beat the 87.2M-ton common estimate amongst analysts tracked by Bloomberg.

Q3 nickel manufacturing surged 71.5% to 51.8K metric tons, as refineries resumed after a upkeep interval, however nickel gross sales gained simply 6%.

Vale (VALE) is now reconsidering a near-term spinoff of its base metals enterprise and an eventual public itemizing, ring-fencing the copper and nickel unit from the iron ore enterprise.

Source link