[ad_1]

Simple financial coverage may appear enjoyable firstly, nevertheless it has penalties.

Whereas asset costs shot up in 2020 and 2021, they pulled again considerably in 2022. In the meantime, inflation stays close to 40-year highs and the Fed has to lift rates of interest aggressively to carry worth ranges below management.

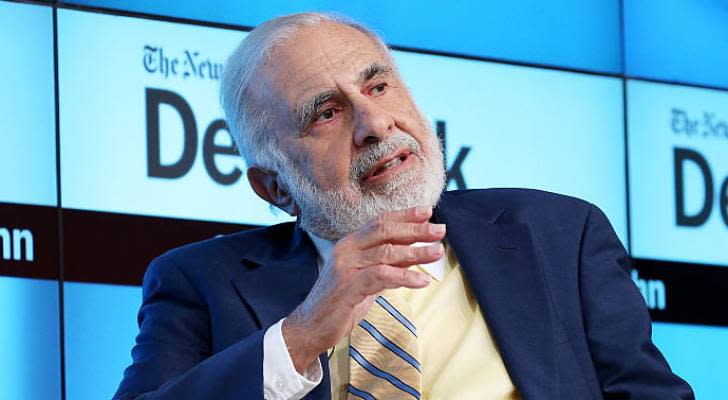

“We printed up an excessive amount of cash, and simply thought the occasion would by no means finish. And the occasion’s over,” Billionaire investor Carl Icahn says at MarketWatch’s Finest New Concepts in Cash Pageant on Wednesday by way of a distant feed.

Nonetheless, though many buyers suffered painful losses in 2022 — the S&P 500 had its worst first half of the 12 months since 1970 — Icahn shouldn’t be one in every of them. At his firm Icahn Enterprises, the web asset worth went up about 30% within the first six months of this 12 months.

Wanting forward, his outlook isn’t precisely optimistic.

“The worst is but to return,” Icahn says, whereas cautioning that “inflation is a horrible factor” and “you possibly can’t remedy it.”

That stated, he doesn’t counsel it is best to bail on shares fully.

“I believe plenty of issues are low-cost, they usually’re going to get cheaper,” he says.

Given Icahn’s massively profitable profession as an investor, folks need to know the place he sees alternative proper now.

“I’m simply curious what shares look low-cost and viable proper now,” an viewers member requested him through the Q&A session.

Icahn supplied two names.

Power was by far the S&P 500’s best-performing sector in 2021, returning a complete of 53% vs the index’s 27% return. And that momentum has carried into 2022.

12 months so far, the Power Choose Sector SPDR Fund (XLE) is up a strong 35%, in stark distinction to the broad market’s double-digit decline.

Icahn’s choose within the vitality house is CVR Power (CVI), which is especially within the refinery enterprise. He says that the inventory “is sort of low-cost, although it’s come up lots.”

CVR Power shares have surged 50% 12 months so far and 74% over the past 12 months.

As you’d anticipate from this type of share worth efficiency, the corporate is firing on all cylinders.

In Q2 of 2022, CVR Power introduced in $3.1 billion of internet gross sales, up from $1.8 billion within the year-ago interval.

The enterprise received extra profitable, too, because the refining margin per whole throughput barrel improved to $26.10 in Q2, marking an enormous improve from $6.72 in the identical interval final 12 months.

The corporate not too long ago declared a particular dividend of $2.60 per share — on high of its common quarterly money dividend of 40 cents per share.

Ichan additionally likes the enterprise as a result of “you possibly can’t construct one other refinery on this nation.”

Learn extra: What do Ashton Kutcher and a Nobel Prize-winning economist have in frequent? An investing app that turns spare change right into a diversified portfolio

CVR Companions is a grasp restricted partnership created by CVR Power to personal, function, and develop its nitrogen fertilizer enterprise.

Whereas the 2 entities are associated — CVR Power subsidiaries personal 37% of the frequent models of CVR Companions — CVR Companions can be publicly traded. Its ticker image is UAN.

“[The] fertilizer enterprise, to me, is a superb enterprise immediately,” Icahn says.

CVR Companions’ manufacturing amenities primarily produce ammonia and urea ammonium nitrate (UAN) fertilizers, and people issues are in sturdy demand.

In Q2, the partnership’s common realized gate worth for UAN shot up 134% 12 months over 12 months to $555 per ton. For ammonia, the typical realized gate worth rose 193% 12 months over 12 months to $1,182 per ton.

Unsurprisingly, CVR Companions has been one other stellar performer on this ugly market because the inventory is up 29% 12 months so far.

It’s straightforward to see why the enterprise is interesting to Icahn.

“You want fertilizer if you wish to eat,” he says.

Certainly, in order for you the final word hedge in opposition to all of the uncertainties the world is dealing with immediately, agriculture deserves a critical look, even when nothing about farming.

This text gives info solely and shouldn’t be construed as recommendation. It’s supplied with out guarantee of any sort.

In the rapidly evolving digital marketing landscape, finding content creators who authentically represent your brand…

Before diving into the specifics, it's important to understand what a demolition contractor does. These…

Hey there! If you're cruising around Arlington and suddenly find your windshield cracked or shattered,…

Hello there! If you're searching for the top asphalt paving companies in Indiana, you're in…

Hey there! If you've ever driven on a smooth, sleek road and thought, "Wow, this…

Hello, enterprising souls of Anaheim! Are you eager to breathe new life into your commercial…