Invoice seeks delay of EV tax credit score American sourcing guidelines

[ad_1]

Congressional lawmakers are searching for to delay necessities for domestically sourced content material below the revamped federal EV tax credit score.

Payments lately launched within the Senate and Home of Representatives would create a extra gradual phase-in for these necessities than is specified by the brand new EV tax credit score guidelines enacted below the Inflation Discount Act (IRA).

The Senate model was launched by Georgia Democratic Senator Raphael Warnock (who now faces a runoff election towards Republican challenger Herschel Walker), with the companion Home invoice launched earlier this month by Representatives Terri Sewell of Alabama, Emanuel Cleaver of Missouri, and Eric Swalwell—all Democrats who gained their respective midterm races.

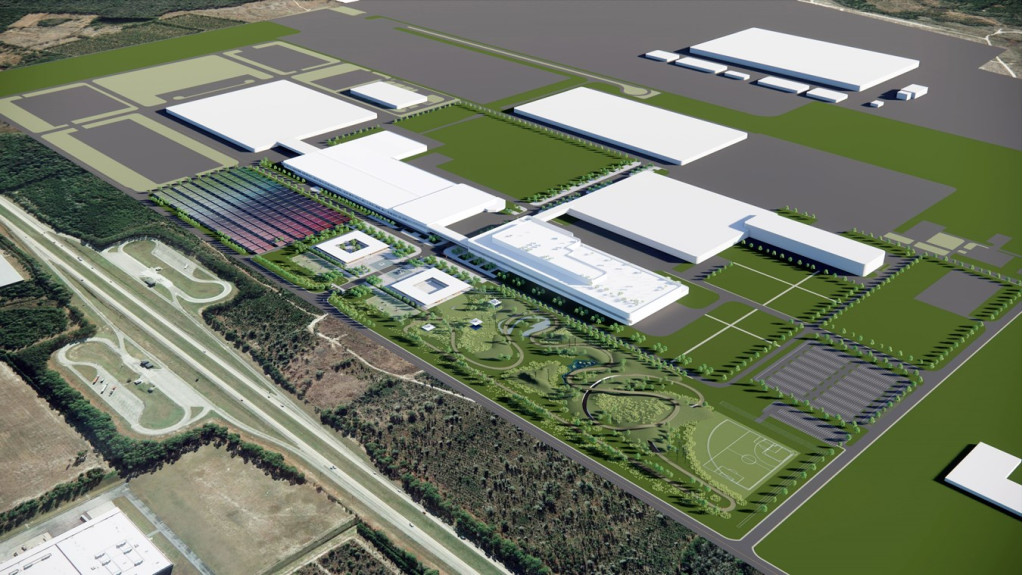

Mercedes-Benz battery manufacturing facility

Below the IRA, the tax credit score stays unchanged at $7,500. However to qualify for the total quantity, EVs and their battery packs should be assembled in North America, and sure minerals utilized in batteries should be sourced both domestically or from international locations with whom america has a free commerce settlement.

Particular guidelines for the battery-mineral part weren’t included within the IRA, resulting in some confusion about which EVs would truly qualify, however the Inner Income Service (IRS) and U.S. Treasury Division stated in October that these guidelines will get fast-tracked, with steerage for automakers anticipated to look earlier than the top of the 12 months.

However this new laws may see implementation of these guidelines delayed. It might solely require EVs offered after December 31, 2025, to be assembled in North America, with delays for the mineral and home battery manufacturing necessities as nicely.

Kia EV manufacturing in Georgia

The IRA reportedly gave Hyundai encouragement to fast-track its personal U.S. EV manufacturing at its manufacturing facility in Warnock’s state of Georgia. Hyundai since then confirmed Kia EVs from the plant and stated that it’d develop the plant for 500,000 EVs yearly.

Normal Motors, which is already manufacturing some EVs within the U.S. however probably will not meet battery-sourcing necessities, lately famous that it nonetheless expects to qualify for the $3,750 in the beginning of the 12 months, plus the total $7,500 quantity in 2-3 years.

This extension seems to ask for no change on the value and revenue caps, so the tax credit score would nonetheless be extra restricted than beforehand—and can add urgency to the arrival of inexpensive EVs.

Source link