A Nice Copper Squeeze Is Coming for the World Financial system

[ad_1]

(Bloomberg) — The value of copper — utilized in the whole lot from pc chips and toasters to energy programs and air conditioners — has fallen by almost a 3rd since March. Traders are promoting on fears {that a} international recession will stunt demand for a steel that is synonymous with development and growth.

Most Learn from Bloomberg

You would not realize it from trying on the market in the present day, however a number of the largest miners and metals merchants are warning that in simply a few years’ time, an enormous shortfall will emerge for the world’s most crucial steel — one that might itself maintain again international development, stoke inflation by elevating manufacturing prices and throw international local weather objectives off track. The current downturn and the under-investment that ensues solely threatens to make it worse.

“We’ll look again at 2022 and suppose, ‘Oops,’” stated John LaForge, head of actual asset technique at Wells Fargo. “The market is simply reflecting the quick considerations. However for those who actually thought concerning the future, you may see the world is clearly altering. It will be electrified, and it is going to want lots of copper.”

Inventories tracked by buying and selling exchanges are close to historic lows. And the most recent value volatility signifies that new mine output — already projected to begin really fizzling out in 2024 — may turn into even tighter within the close to future. Simply days in the past, mining large Newmont Corp. shelved plans for a $2 billion gold and copper challenge in Peru. Freeport-McMoRan Inc., the world’s largest publicly traded copper provider, has warned that costs are actually “inadequate” to help new investments.

Commodities specialists have been warning of a possible copper crunch for months, if not years. And the most recent market downturn stands to exacerbate future provide issues — by providing a false sense of safety, choking off money circulation and chilling investments. It takes no less than 10 years to develop a brand new mine and get it operating, which signifies that the selections producers are making in the present day will assist decide provides for no less than a decade.

“Vital funding in copper does require an excellent value, or no less than an excellent perceived longer-term copper value,” Rio Tinto Group Chief Government Officer Jakob Stausholm stated in an interview this week in New York.

Why Is Copper Necessary?

Copper is crucial to fashionable life. There’s about 65 kilos (30 kilograms) within the common automobile, and greater than 400 kilos go right into a single-family dwelling.

The steel, thought-about the benchmark for conducting electrical energy, can also be key to a greener world. Whereas a lot of the eye has been centered on lithium — a key part in in the present day’s batteries — the power transition will probably be powered by a wide range of uncooked supplies, together with nickel, cobalt and metal. With regards to copper, tens of millions of ft of copper wiring will probably be essential to strengthening the world’s energy grids, and tons upon tons will probably be wanted to construct wind and photo voltaic farms. Electrical autos use greater than twice as a lot copper as gasoline-powered automobiles, based on the Copper Alliance.

How Large Will the Scarcity Get?

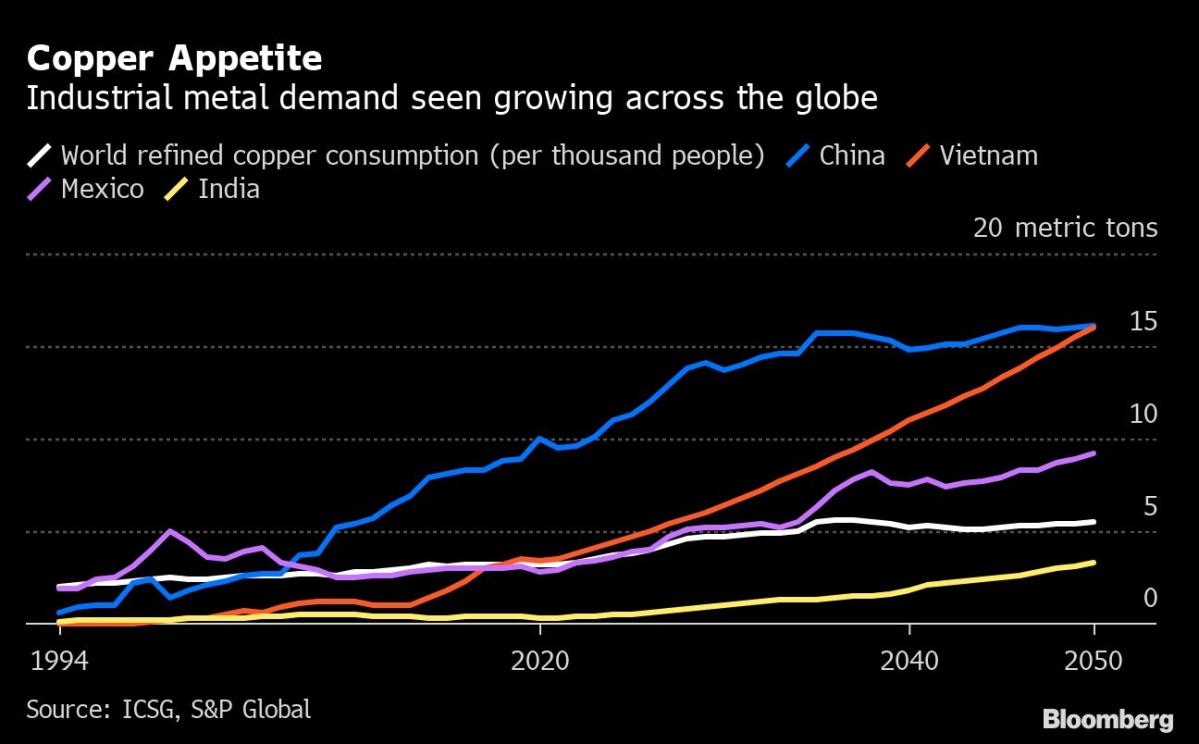

Because the world goes electrical, net-zero emission objectives will double demand for the steel to 50 million metric tons yearly by 2035, based on an industry-funded examine from S&P World. Whereas that forecast is basically hypothetical given all that copper cannot be consumed if it is not accessible, different analyses additionally level to the potential for a surge. BloombergNEF estimates that demand will improve by greater than 50% from 2022 to 2040.

In the meantime, mine provide development will peak by round 2024, with a dearth of recent initiatives within the works and as current sources dry up. That’s establishing a state of affairs the place the world may see a historic deficit of as a lot as 10 million tons in 2035, based on the S&P World analysis. Goldman Sachs Group Inc. estimates that miners have to spend about $150 billion within the subsequent decade to unravel an 8 million-ton deficit, based on a report revealed this month. BloombergNEF predicts that by 2040 the mined-output hole may attain 14 million tons, which must be stuffed by recycling steel.

To place in perspective simply how large that scarcity can be, take into account that in 2021 the worldwide deficit got here in at 441,000 tons, equal to lower than 2% of demand for the refined steel, based on the Worldwide Copper Examine Group. That was sufficient to ship costs leaping about 25% that yr. Present worst-case projections from S&P World present that 2035’s shortfall will probably be equal to about 20% of consumption.

As for what which means for costs?

“It’s going to get excessive,” stated Mike Jones, who has spent greater than three many years within the steel {industry} and is now the CEO of Los Andes Copper, a mining exploration and growth firm.

The place Are Costs Heading?

Goldman Sachs forecasts that the benchmark London Steel Alternate value will virtually double to an annual common of $15,000 a ton in 2025. On Wednesday, copper settled at $7,690 a ton on the LME.

“All of the indicators on provide are pointing to a reasonably rocky street if producers don’t begin constructing mines,” stated Piotr Kulas, a senior base metals analysts at CRU Group, a analysis agency.

In fact, all these mega-demand forecasts are predicated on the concept governments will hold pushing ahead with the net-zero targets desperately wanted to fight local weather change. However the political panorama may change, and that might imply a really completely different state of affairs for metals use (and the planet).

And there’s additionally a typical adage in commodity markets that might come into play: excessive costs are the treatment for top costs. Whereas copper has dropped from the March file, it’s nonetheless buying and selling about 15% above its 10-year common. If costs hold climbing, that may ultimately push clean-energy industries to engineer methods to cut back metals consumption and even search alternate options, based on Ken Hoffman, the co-head of the EV battery supplies analysis group at McKinsey & Co.

Scrap provide can assist fill mine-production gaps, particularly as costs rise, which is able to “drive extra recycled metals to seem out there,” stated Sung Choi, an analyst at BloombergNEF. S&P World factors to the truth that as extra copper is used within the power transition, that will even open extra “alternatives for recycling,” akin to when EVs are scrapped. Recycled manufacturing will come to signify about 22% of the overall refined copper market by 2035, up from about 16% in 2021, S&P World estimates.

The present international financial malaise additionally underscores why the chief economist for BHP Group, the world’s largest miner, simply this month stated copper has a “bumpy” path forward due to demand considerations. Citigroup Inc. sees copper falling within the coming months on a recession, notably pushed by Europe. The financial institution has a forecast for $6,600 within the first quarter of 2023.

And the outlook for demand from China, the world’s largest metals client, will even be a key driver.

If China’s property sector shrinks considerably, “that is structurally much less copper demand,” stated Timna Tanners, an analyst at Wolfe Analysis. “To me, that is simply an essential offset” to the consumption forecasts primarily based on net-zero objectives, she stated.

However even a recession will solely imply a “delay” for demand, and it gained’t “considerably dent” the consumption projections going into 2040, based on a presentation from BloombergNEF dated Aug. 31. That’s as a result of a lot of future demand is being “legislated in,” by governments’ concentrate on inexperienced objectives, which makes copper much less depending on the broader international economic system than it was once, stated LaForge of Wells Fargo.

Plus, there’s little wiggle room on the provision facet of the equation. The bodily copper market is already so tight that regardless of the stoop in futures costs, the premiums paid for instantly supply of the steel have been shifting increased.

What’s Holding Again Provides?

Simply check out what’s occurring in Chile, the legendary mining nation that’s lengthy been the world’s largest provider of the steel. Income from copper exports is falling due to manufacturing struggles.

At mature mines, the standard of ore is deteriorating, which means output both slips or extra rock must be processed to provide the identical quantity. And in the meantime the {industry}’s pipeline of dedicated initiatives is operating dry. New deposits are getting trickier and pricier to each discover and develop. In Peru and Chile, which collectively account for greater than a 3rd of world output, some mining investments have stalled, partly amid regulatory uncertainty as politicians search a better portion of income to resolve financial inequalities.

Hovering inflation can also be driving up the price of manufacturing. Meaning the typical incentive value, or the worth wanted to make mining enticing, is now roughly 30% increased than it was 2018 at about $9,000 a ton, based on Goldman Sachs.

Globally, provides are already so tight that producers are attempting to squeeze tiny nuggets out of junky waste rocks. Within the US, firms are operating into allowing roadblocks. Whereas within the Congo, weak infrastructure is limiting development potential for main deposits.

Learn Extra: Greatest US Copper Mine Stalled Over Sacred Floor Dispute

After which there’s this nice contradiction on the subject of copper: The steel is crucial to a greener world, however digging it out of the earth could be a fairly soiled course of. At a time when everybody from native communities to international provide chain managers are heightening their scrutiny of environmental and social points, getting approvals for brand spanking new initiatives is getting a lot tougher.

The cyclical nature of commodity industries additionally means producers are dealing with strain to maintain their steadiness sheet robust and reward traders reasonably than aggressively embark on development.

“The inducement to make use of money flows for capital returns reasonably than for funding in new mines is a key issue resulting in a scarcity of the uncooked supplies that the world must decarbonize,” analysts at Jefferies Group LLC stated in a report this month.

Even when producers change gears and abruptly begin pouring cash into new initiatives, the lengthy lead time for mines signifies that the provision outlook is just about locked in for the subsequent decade.

“The short-term state of affairs is contributing to the stronger outlook long run as a result of it is having an impression on provide growth,” Richard Adkerson, CEO of Freeport-McMoRan, stated in an interview. And within the meantime, “the world is changing into extra electrified in all places you look,” he stated, which inevitably brings “a brand new period of demand.”

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link