Family debt rises 2.2% in Q3 to $16.51T; mortgage originations decline

[ad_1]

coldsnowstorm

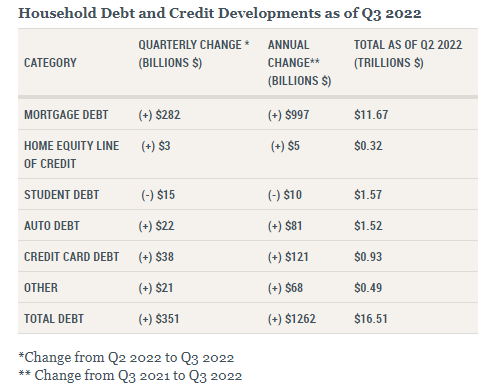

U.S. family debt elevated by 2.2% in Q3 2022 to $16.51T, and now stands $2.36T increased than on the finish of 2019, earlier than COVID-19 triggered a pointy, however fast, recession, in line with the New York Fed’s Quarterly Report on Family Debt and Credit score.

“Bank card, mortgage, and auto mortgage balances continued to extend within the third quarter of 2022 reflecting a mixture of strong shopper demand and better costs,” stated Donghoon Lee, financial analysis advisor on the New York Fed. “Nonetheless, new mortgage originations have slowed to pre-pandemic ranges amid rising rates of interest.”

Mortgage balances rose by $282B within the quarter, lifting the whole to $11.67T on the finish of September, and representing a $1T improve from 2021.

Bank card balances rose by $38B throughout the quarter and 15% Y/Y, the most important increase in additional than 20 years.

Auto mortgage balances grew by $22B throughout the quarter, per its upward pattern since 2011. Pupil mortgage balances declined barely and now stand at $1.57T.  Supply: NY Fed

Supply: NY Fed

Not surprisingly, increased rates of interest constrained mortgage lending. Mortgage originations, which embrace refinances, had been $633B in Q3, a $126B decline from Q2.

Newly originated auto loans, at $185B, had been a slight discount from the earlier quarter however had been nonetheless elevated to common volumes seen in 2018-2019 interval.

The share of present debt changing into delinquent elevated for nearly all debt sorts, after two years of traditionally low delinquency transitions. The delinquency transition charge for bank cards and auto loans elevated by about half a proportion level, just like will increase in Q2, the New York Fed stated.

Supply: NY Fed

In November, shopper sentiment turned glummer in November as inflation expectations ticked up, in line with the College of Michigan survey

Source link