Investor’s recommendation throughout a downturn: Don’t panic • TechCrunch

[ad_1]

The way to compete with out dropping your thoughts — and your runway

Competing in an more and more crowded house might be nerve-wracking. Competing in an more and more crowded house amid a difficult fundraising setting is much more nerve-wracking.

Everyone knows that money is just not almost as available in 2022 because it was in 2021. This places startups within the place of getting to compete with out dropping their minds — or runway.

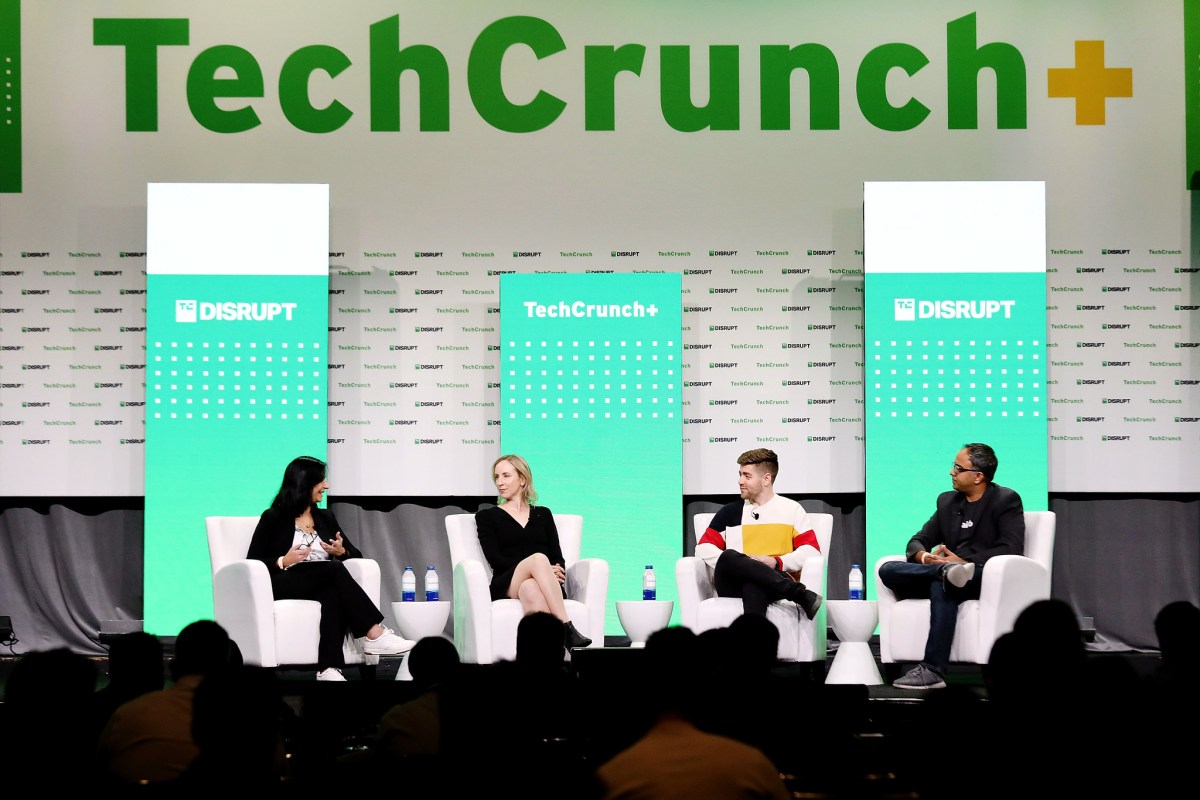

At TechCrunch Disrupt 2022, I interviewed Ramp CEO Eric Glyman, Airbase CEO Thejo Kote and Anthemis associate Ruth Foxe Blader on the subject. Glyman and Kote shared how they’re working to protect capital, whereas Blader supplied up among the recommendation she’s giving to her portfolio corporations. And he or she didn’t maintain again.

For the unacquainted, Glyman and Kote each run startups within the spend administration house. As pleasant rivals, they acknowledged that whereas the class is just not a winner-takes-all one, it’s nonetheless essential to distinguish and repeatedly innovate.

Stated Glyman: “One of many issues that we’ve completed in our enterprise has been to have a look at the price of acquisition — to completely earn again the fee deployed — and we’ve lowered that threshold,” he stated. “And so our view is that we wish to develop as quick as doable, however at a a lot sooner tolerance — in that very same method the place you possibly can earn larger yield elsewhere, making use of that rigorous framework to the place you select to deploy capital. We expect that is the proper method for this setting.”

For Kote, it’s largely about focus. Airbase, he famous, has traditionally focused the mid-market and early enterprise house. He referenced “the loopy 2021 interval the place there was all of the madness round funding on this house,” with buyers “prepared to pay 100x, 200x multiples.” Relatively than frantically attempt to change Airbase’s mannequin to fulfill expectations, Kote stated the startup saved working the way in which it at all times had.

“So a silver lining from a spotlight perspective coming into this 12 months for us has been, ‘You realize what? None of that issues,’” Kote stated. “We have been very centered on subscription income and high-margin subscription income and internet ARR — not gross ARR. So we now have actually caught to what we now have at all times completed, which is concentrated on the mid-market. And that meant that we freed up sources in a bunch of how, giving us extra runway.”

In the meantime, Blader — whose agency invests in any respect levels of the life cycle — shared her perception that “this can be a sentiment-driven business, and when the music’s enjoying, everyone dances.”

“The individuals who danced in 2021 and raised a bunch of capital – sufficient capital to hit breakeven with possibly somewhat little bit of burn slicing, are in all probability feeling fairly good,” she stated. “And the parents who actually both under-raised or didn’t increase or raised capital at a valuation the place they’re actually not going to have the ability to shut the hole between the place multiples have been and the place they’re now, are barely panicked.”

Source link