Supplies sector continues to see pink as macro pressures persist

[ad_1]

Nordroden

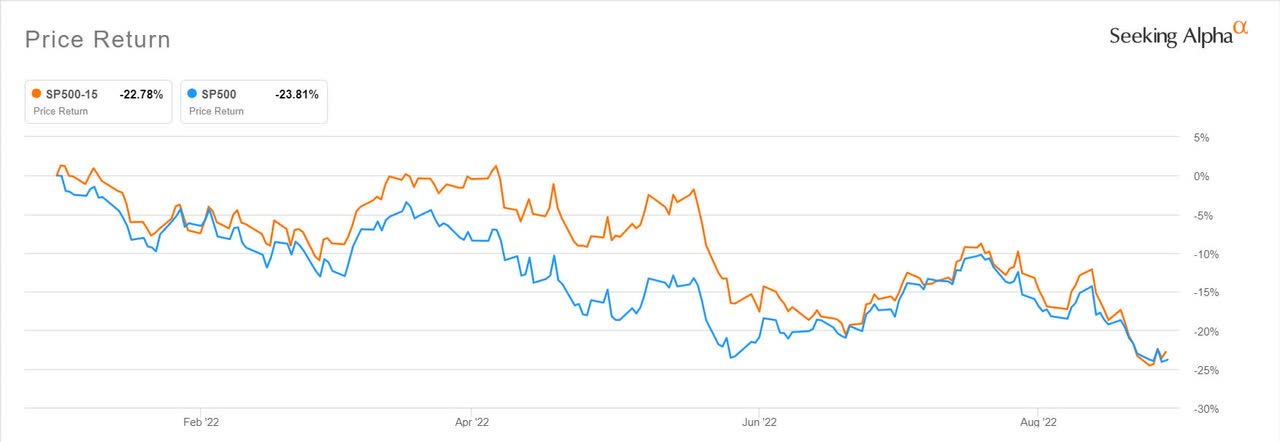

Supplies shares dropped round -23% within the first 9 months of 2022, in contrast with an round -24% drop for the S&P 500 and SPDR S&P 500 Belief ETF (SPY). Supplies Choose Sector SPDR ETF (XLB) was additionally down round -23% through the interval and dropped -7.35% in Q3.

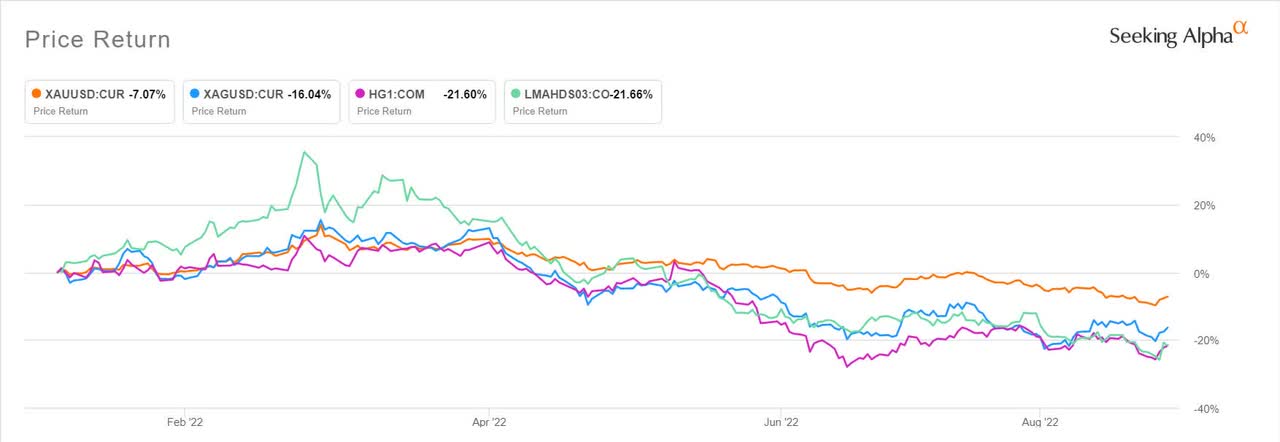

Industrial metals had a tough six months, and Q3 continued to see the sector harm by tight provide situations ever. On the London Metallic Trade, three-month copper (HG1:COM) closing costs have fallen practically -9%. In keeping with Reuters, benchmark LME copper lately traded -0.8% at $7,375/metric ton after tumbling to as little as $7,292, the bottom since July 21.

In the meantime, LME aluminum costs (LMAHDS03:COM) have continued to drop to new 18-month lows and fell round -10% in Q3. The metals proceed to be weighed by ongoing fears of a world development slowdown, weaker demand and a better greenback.

Aluminum consumption and costs are anticipated to stay beneath strain resulting from slowing development, and a manufacturing ramp-up in China is also weighing on costs.

Lumber costs (LB1:COM) have dropped by greater than -60% YTD to their lowest in additional than two years, and a restoration appears unbelievable provided that increased rates of interest and inflation seemingly will proceed to harm demand for single-family houses.

The speed at which new U.S. housing is being constructed is down -13% from April, when residential development exercise hit its highest stage in additional than a decade, in accordance with the Census Bureau.

Three-month comex gold (XAUUSD:CUR) additionally hit a contemporary two-and-a-half yr low lately, and has dropped practically 9% in Q3. Silver (XAGUSD:CUR) additionally completed -9% at $18.84/oz because the greenback jumped in opposition to main currencies and rising worries that central financial institution tightening may spark a world recession.

The greenback touched a 20-year excessive, hurting demand for dollar-priced bullion, whereas benchmark 10-year yields popped to their highest since April 2010.

“The dangers of a tough touchdown are elevated and this has been persevering with to drive flows into the greenback, which has been unhealthy information for gold,” Oanda’s Edward Moya stated.

Let’s check out the top-performing materials shares ($2B market cap or extra) for Q3.

- Sigma Lithium (SGML) +76.56%; Lithium shares made up 4 of the highest 5 gainers on the again of surging lithium costs. The steel has skyrocketed practically 500% through the previous yr because of tight provide and rising demand for electrical autos.

- Livent Corp (LTHM) +35.08%

- Lithium Americas (LAC) +30.30%

- Albemarle (ALB) +26.54%

- CF Industries (CF) +12.27%; The inventory has been rallying on the energy of fertilizer costs, that are anticipated to stay elevated for the foreseeable future.

The worst performing materials shares ($2B market cap or extra) had been:

- Scotts Miracle-Gro (SMG) -45.88%; Margins and development have come down for the agri agency this yr, with monetary outcomes falling in need of market expectations.

- Avantor (AVTR) -36.98%; Shares have fallen lately on steerage cuts.

- Braskem (BAK) -31.79%; Shares are down practically 51% YTD, though SA authors and Wall Road charge the inventory as a Purchase.

- Newmont (NEM) -29.56%; The inventory is amongst a number of treasured metals movers which have seen sustained strain from a drop in gold costs.

- Alcoa (AA) -26.15%; Shares have dropped 45% YTD on aluminum weak spot.

Different supplies ETFs to look at: iShares International Timber & Forestry ETF (WOOD), Supplies Choose Sector SPDR ETF, Vanguard Supplies ETF (VAW), iShares International Supplies ETF (MXI), SPDR S&P Metals and Mining ETF (XME), VanEck Vectors Gold Miners ETF (GDX), iShares MSCI International Gold Miners ETF (RING), International X Copper Miners ETF (COPX).

Source link